With the U.S. presidential election, a second potential rate cut from the Federal Reserve and the home health final payment rule all nearing, October was a waiting game for the companies on the post-acute care index (PAI) and home health index (HHI).

Now that those three are in the rearview mirror, providers will begin to feel their impact — positive or negative. But more than anything, they will gain far more certainty heading into the final months of the year.

The Centers for Medicare & Medicaid Services’ (CMS) final rule comes with an estimated aggregate increase to 2025 home health payments of 0.5%, or $85 million, compared to 2024 aggregate payments. More permanent cuts, however, are on the way.

Though providers have suffered payment cuts in traditional Medicare for three straight years, the final rule did end up more positive than the proposed rule in June, which included a 1.7% cut to aggregate payments.

The election of Donald Trump to the presidency could affect the Medicare and Medicaid payment environments in both home health care and home care. It also could impact pending regulation, such as the 80-20 provision included in the Medicaid Access Rule.

“The buyer-seller gap in home-based care has been closing, and will continue to close in the remaining months of the year,” says Joe Lynch, Partner and Managing Director at Stoneridge Partners. “Certainty always bodes well for M&A, and there is far more certainty now than there was in the summer.”

The home health index was down 2.8% in October. The post-acute care index had an uncharacteristically poor month, down 6.7%. Comparatively, the S&P was down 1%.

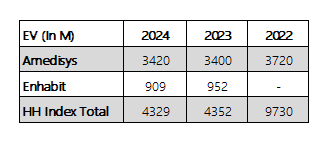

Home Health Index

October was a noisy month for UnitedHealth Group’s (NYSE: UNH) planned takeover of Amedisys Inc. (Nasdaq: AMED). In late October, Bloomberg reported that leaders of each company would be meeting with the Department Of Justice (DOJ) to discuss whether a lawsuit would be filed to block the deal or not.

That meeting was then postponed until after the Nov. 5 election. With new DOJ leadership set to be ushered in after the new year, it’s still unclear whether the current regime will go ahead with a lawsuit.

Amedisys stock was down slightly in October, by 2%. It’s now been almost a year and a half since UnitedHealth Group first agreed to acquire Amedisys in June of 2023.

Enhabit Inc. (NYSE: EHAB), meanwhile, has a new CFO. Crissy Carlisle — who has served as CFO of the company since it spun off of Encompass Health (NYSE: EHC) – will be replaced by Ryan Solomon on Dec. 9.

“Ryan’s experience in the home health and hospice space, along with his proven track record as a chief financial officer and his accomplishments in financial, operational and strategic leadership, make him ideally suited to serve as Enhabit’s next CFO,” Enhabit CEO Barb Jacobsmeyer said in a statement. “Ryan’s deep understanding of how to link financials with performance drivers aligns well with our objectives. The Enhabit team has worked hard to stabilize the business, and we look forward to benefiting from Ryan’s fresh perspectives to build on our momentum as we advance our position as a leading national home health and hospice provider.”

Enhabit was down 12.78% in October as it looks to kickstart a turnaround heading into 2025.

Post-Acute Care Index

Year to date, BrightSpring Health Services (Nasdaq: BTSG) is up over 70%. The company has been one of the more active acquirers during an M&A downturn, and plans to do more of the same in the near-term future.

BrightSpring CEO Jon Rousseau said on the company’s third-quarter earnings call that home health and hospice acquisitions offer a “high return on investment” for the company.

“From an acquisition strategy perspective, I think it’s going to be consistent with what we’ve done over the past couple of years,” Rousseau said. “On the provider side, it’s been rehab, home health and hospice, and then home-based primary care as well. We currently have three or four very small tuck-ins for home health and hospice, which are high returns on investment. On the de novo side, it’s really on home health, hospice and rehab.”

Addus Homecare Corp. (Nasdaq: ADUS) and The Pennant Group (Nasdaq: PNTG) are the other public home-based care providers that have continued to acquire during the downturn.

As competition intensifies for high-quality assets with interest rates coming down, these companies will likely reap the benefits of remaining aggressive during a quiet period.

Addus specifically is waiting for its $350 million purchase of Gentiva’s personal care assets to close. After that purchase, Addus will expand its footprint, as the company prioritizes operations in solid home-and community-based services (HCBS) markets.

“We believe our personal care segment benefits from both scale and broad geographic coverage in the states where we operate,” Addus CEO Dirk Allison during the company’s third-quarter earnings call. “This is particularly true in managed Medicaid states, and as a result of the final Medicaid access rule, if and when it may be implemented, this scale and coverage allows us to spread our costs over a larger revenue base and provides Addus with the opportunity for meaningful advocacy with the states in which we operate, while also promoting a more favorable hiring and retention environment.”

Addus expects the Gentiva deal to close during the fourth quarter.

Quote of the Month

“We see on a daily basis with all of our members, it makes a difference when home health shows up, but we don’t necessarily agree that this is going to solve the issue. We’re concerned that CMS is going in the wrong direction. We hope that CMS will continue to look at this issue, and evolve a little bit in their thinking of how we address the referral rejections and lack of access.” – Katy Barnett, Director of Home Care and Hospice Operations and Policy at LendingAge

Read the Full Article Here: CMS Home Health Admission-To-Service Policy Misses The Heart Of Providers’ Capacity Issues

See Stoneridge’s Latest Blog:

Read the first in a series of articles that will provide a unique and in-depth dive into home health and hospice valuations to provide answers to two of the most important questions that owners want to know, “What is the value of my business” and “How much will it sell for?”

Read the Full Article Here: Home Health & Hospice: How Valuation Works in M&A

November is Home Care & Hospice Month

Stoneridge would like to take the time to recognize and celebrate the millions of people who offer the best health care in the country. You make an everlasting impact, and we thank you for your service!

See It To Believe It!

The Stoneridge Partners Home Health Index (HH Index) is updated monthly and measures the performance of these two publicly traded home health companies, all listed on the NASDAQ:

- Amedisys (AMED)

- Enhabit (EHAB)

Here are the results of the stock prices for the past two years:

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

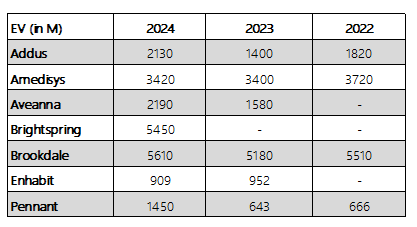

The Stoneridge Partners Post-Acute Care Index is updated monthly and measures the performance of these seven publicly traded post-acute care companies, all listed on the NASDAQ:

- Addus (ADUS)

- Amedisys (AMED)

- Aveanna (AVAH)

- Brightspring (BTSG)

- Brookdale Senior Living Inc. (BKD)

- Enhabit (EHAB)

- The Pennant Group, Inc. (PNTG)

Here are the results of the Post-Acute stock prices for the past two years:

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

This graph displays 24 months of Post-Acute Care Index performance.

The above calculations are based on selling price being defined as Enterprise Value (EV), with data provided by Yahoo Finance. Enterprise value is defined as market cap plus debt, minority interest and preferred shares, minus total cash and cash equivalents. EBITDA is calculated using methodology which may differ from that used by a company for its reporting. (Home Health Index October 2024 | Stoneridge Partners)

Recent Transactions From Around The Country

- Texas-based New Day Healthcare LLC acquired Intrepid USA’s hospice operations in Missouri and Texas

- Eden Health of Northern Nevada, dba Eden Hospice, acquired A Plus Hospice Care

SOLD by Stoneridge!!!

- Stoneridge Partners is proud to announce the successful sale of a Minnesota behavioral health agency

View Stoneridge closed transactions on our Website.

Exclusively Listed For Sale By Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Non-skilled home care and adult day services. $3.3M in revenue. Certificate of Need. 75% Medicaid.

Mental health counseling & therapy center. $1M in revenue. Long-established practice with excellent reputation.

Home care company. $7M in revenue. 20%+ AEBITDA. 90%+ non-medical. Primarily auto-injury related/long-term clients. Payor sources are mainly auto insurers.

Fully licensed and accredited SUD clinic. $3.5M in annual revenue. Operating continuously for over 40 years. 2 locations with residential and outpatient services.

Home care agency. $16M+ revenue. 100% Medicaid-reimbursed. Approx. 50% skilled/50% non-medical. Medicare-certified.

Home health agency. $3M in revenue. 75% Medicaid, but Medicare Certification as well. Long history of success.

4 adult care homes in Eastern NC. 99 beds licensed under adult care homes. CON status on this license category in NC. Some renovations needed,...

Non-skilled home care agency. $3.7M in revenue. 100% Medicaid. 2 offices in major metro locations.

Medicaid home health provider in major Texas MSA. $1.9M of 2025 annualized revenue. 20-year history in the community. Quality staff in place.

Multi-State Mental Health Services Provider. $2.75M in revenue. Efficient cost structure and consistent earnings. Proven scalable platform.

Fully licensed and accredited behavioral health clinic. Licensed for outpatient substance abuse and mental health therapy. Other license categories are easy to add. Credentialed with...

Medicaid wavier provider. Serving six counties in south central PA for 25+ years. Licensed to provide CHC, Attendant Care ACT 150, and OBRA Waivers. $262k...

Medicare-certified home health agency. $3.2M in LTM revenue. Medicaid programs comprise nearly 65% of the revenue. VA and private insurance. 4 locations serving 21 counties.

Hospice. 160+ ADC and growing. Multiple locations. No CAP issues.

Independent home health provider. $16.8M LTM in revenue with 13.1% EBITDA. Organic growth of 16.7% over the last 3 years. 44% traditional Medicare, 49% Medicare...

Home care agency specializing in Medicaid family-supported services. $10M in revenue/$3M EBITDA. 10-year history. Locally acclaimed.

Medicare-certified home health agency. $15M+ in revenue. All skilled. Experienced leadership team. Accredited.

Home health and home care agency providing care to Medicare, Medicaid LTC Waiver, Pediatric and Advanced Neurological patients. $4.5M in revenue. AEBITDA of over 12%. ...

Hospice and IPU. $5.5M in revenue. Deep community ties in a major MSA. Highly dedicated and trained staff.

Home care company. $6M in revenue. Non-medical. Medicaid. Family Caregivers.

Home Care / Pennsylvania / Popular

Home health & hospice. $10M in revenue. Great referral sources. Well-established. On HCHB.

Home care company. $7M in revenue. Private pay, non-medical. Accredited.

Medicare and Medicaid-certified home health agency. Approx. $400k in revenue. Central Arizona.

Professionally operated home health agency. $1.8M in revenue. 20% EBITDA margins. 20+ years in the Houston market.

Home Health / Texas / Popular

Home care franchise. $1.3M in revenue. 13+ years in business. Large territory with growth potential.

Outpatient behavioral health provider. $4.5M+ in LTM revenue. Year-over-year revenue growth. Growth/expansion opportunities with a new location and new services. Licensed to serve a total...

Behavioral Health / Pennsylvania / Popular

Nurse registry. $7M in revenue. 100% private pay. Primarily non-medical home care. District 9.

Long-established Medicare/Medicaid home health agency with multiple locations. $7.3M in revenue. Good payor mix. On Homecare Homebase.

Home Health / Ohio / Popular

Home health agency in 2 states, one a CON. $3M+ in revenue. Good payor mix. 5-star patient survey rating.

Home Health / Multi-State / Popular

I/DD provider offering SCL & FHP services. $3M in revenue. Recent rate increase. Strong history in their community.

Behavioral health provider. $5.5M+ revenue with solid EBITDA margins. Leading edge service provider and with proprietary state contracts. Unique combination of service options and contracts...

Behavioral Health / Maryland / Popular

Medicaid/Medicare home health & home care company. $2.4M in revenue. Well-established. Stable revenue. Profitable year-over-year.

Home Health / Connecticut / Popular

Designer/Distributor of innovative, therapeutic, health and wellness personal products. $1.5M+ in revenue. Launched in the US and UK, now launching into the EU. Nearly 7,000...

Staffing Agency licensed to provide staffing services in 6 states. $ 2.4M+ in LTM revenue. Significant long-term contracts with providers in the Care-At-Home space, Health...

Other / Massachusetts / Popular

Homecare agency. $6.5M+ in revenue. Located on Long Island. Blend of Private Duty & Medicaid patients.

Maricopa County hospice. 40+ ADC. CHAP accredited. No CAP or regulatory issues.

Growing ABA (Autism) therapy clinic established in 2020. $1.6M in revenue. Market demand heavily outweighs supply in the area for ABA therapy.

Northeast Oklahoma home health company. $1.7M of revenue and profitable. 95% traditional Medicare. Long history in the area.

Home Health / Oklahoma / Popular

Special education and tutorial provider with limited access contracts. $3M in revenue. Strong relationships with county school programs. Long history in the community, close to...

Medicare-certified home health agency. $1.25M in revenue. AHCA accredited. Broward County (Region 10)

Home Health / Florida / Popular

Medicare-certified home health agency. Region 7, including sought-after Orange county (Orlando). Minimal census.

Home Health / Florida / Popular

$5M in revenue. Located in Northern/Richmond VA. Health system-owned Medicare home health. Growing organization.

Home Health / Popular

Hospice. 45+ ADC. Rio Grande Valley. No CAP or regulatory issues.

$40M+ home care agency with 20+% AEBITDA. Primarily private-duty, non-medical (90%). Medicaid waiver programs. 40% family caregivers. Multiple locations.

Home Care / Pennsylvania / Popular

Home Health Index October 2024 | Stoneridge Partners

From Joe Lynch, Publisher of “Home Health Index.” Joe can be reached at [email protected] or (239) 561-0826, and toll-free at 800-218-3944. Previous editions of this monthly newsletter can be searched for at the bottom of the home page of the Home Health Index.

Joe Lynch, Partner and Managing Director at Stoneridge Partners brings over 30 years of healthcare expertise, specializing in mergers and acquisitions, finance, regulatory compliance, and business development. After earning his Business Administration degree from the University of Mississippi, Joe helped expand OrNda Healthcorp’s (now Tenet’s) home health care division.

In 1997, Joe founded Reachout Home Care, a Medicare and private duty agency, which he grew into three operating companies in Dallas and Houston before selling to Humana in 2014 using Stoneridge Partners. After the sale of his own company Joe joined Stoneridge, and for the last ten years has used his industry knowledge to help other owners list their companies and bring them to a successful close. With a proven track record in operations and M&A, Joe brings unmatched experience and

professionalism to every transaction.

For more information, please contact Joe directly at 214-394-0070 or [email protected]. All communications are confidential.