In 2024, the home health and post-acute care sectors navigated a complex landscape shaped by regulatory shifts, consolidation, and operational pressures. In December, the Home Health Index (HHI) declined 0.54%, while the Post-Acute Care Index (PACI) dropped 2.41%. Meanwhile, the S&P 500 fell 2.50% month-over-month but closed the year with a strong 23.31% year-end increase.

A new major development in December was the extended waiver for the $3.3 billion Amedisys (NASDAQ: AMED)-UnitedHealth merger. The Department of Justice has challenged the merger, citing concerns about potential anti-competitive effects in the home healthcare sector. In response to the lawsuit, Amedisys and UnitedHealth agreed to a new filing that extends the merger deadline to either ten days after the DOJ lawsuit’s final decision or to December 31, 2025, whichever comes first. The original closing date for the deal was December 27, 2024.

The Centers for Medicare & Medicaid Services (CMS) also remained a central focus, particularly with the finalized 2025 payment rule and its modest 0.5% home health rate increase. In addition, Home Health providers are preparing for the transition to all-payer Outcome and Assessment Information Set (OASIS) data collection – voluntary reporting begins on January 1, 2025 for all non-Medicare and non-Medicaid patients. And mandatory compliance by July 1, 2025 for all patients who began receiving care on or after July 1st. While the phased approach allows time for adjustment, many providers are concerned about the rising costs and administrative burdens associated with mandatory OASIS data collection.

Reflecting on 2024, the year presented challenges such as new CMS regulations, including the 2025 payment rule and OASIS data collection requirements, as well as market-wide staffing shortages as demand for in-home care continues to rise. However, the year also introduced new opportunities like advancements in software for streamlining patient intake, and data collection and a growing potential for acquisitions of smaller home health agencies seeking to exit the market.

Joe Lynch, Partner and Managing Director at Stoneridge Partners, observed, “This year has been a turning point for home health and hospice providers. Strategic consolidation and new operational initiatives are laying the groundwork for sustainable growth, even in the face of regulatory shifts and other market challenges. 2025 holds immense potential for providers to capitalize on these changes.”

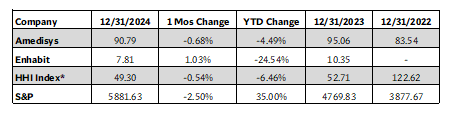

Home Health Index

Amedisys’ stock declined 0.68% month-over-month and 4.49% year-to-date in December as the company attempts to proceed with the UnitedHealth merger. While the extended waiver provides Amedisys with additional time to address regulatory hurdles and resolve merger-related uncertainties, the DOJ lawsuit is not the only challenge the Amedisys-UnitedHealth merger must overcome.

Amedisys, which planned to divest assets to VitalCaring as part of the deal with UnitedHealth, has now halted the sale of these home health and hospice locations. A recent lawsuit resulted in a ruling by the Delaware Court of Chancery that requires VitalCaring to distribute 43% of its future profits to Encompass Health and Enhabit, Inc. While it remains unclear how Amedisys’ decision will affect the broader Amedisys-UnitedHealth merger, it introduces additional complexity to an already challenging process.

Alongside its branch consolidation efforts and payer renegotiations, Enhabit’s (NYSE: EHAB) stock gained 1.03% month-over-month but remains down 24.54% year-to-date. In 2025, Enhabit aims to leverage its updated case management model, which was first implemented in 2022, to continue expanding its patient census and clinical hospice workforce.

Enhabit CEO Barb Jacobsmeyer explained “One of the best things we ever did was investing in the case management model. We knew that added some fixed cost, but what we have found is being able to commit to candidates for hospice, that we have the on-call and triage covered. We’ve seen nice hiring and retention in hospice. We do not have clinical capacity constraints.”

The HHI’s overall 0.54% decline in December tracks with ongoing reimbursement challenges and broader adjustments in the market as companies work to lay the foundation for future expansion.

Post-Acute Care Index

Aveanna Healthcare (NASDAQ: AVAH) experienced a sharp 21.34% month-over-month stock decline, though its overall 70.52% year-to-date increase reflects strong gains made earlier in the year. Aveanna continues to work on expanding their preferred payer agreements to secure better reimbursement rates and support their staffing efforts. “Aveanna preferred payer strategy is gaining momentum and allowing us to invest in caregiver wages and recruitment efforts to accelerate hiring and staffing of nurses for our patients,” according to CEO Jeff Shaner.

Addus (NASDAQ: ADUS) posted a 2.04% month-over-month gain and a 35.00% year-to-date increase. This growth follows initiatives like its $350 million acquisition of Gentiva’s personal care operations, which closed earlier in December. CEO Dirk Allison remarked, “We welcome Gentiva’s experienced personal care operational leadership and caregivers to the Addus family. With our shared experience and expertise, we are well positioned to leverage the strength of the combined operations and provide more consumers and their families with safe, cost-effective care in the preferred home setting.”

The Pennant Group’s (NASDAQ: PNTG) stock fell 14.95% month-over-month despite a 90.52% year-to-date increase. Despite the short-term volatility, Pennant remains optimistic about the long-term benefits of its investment in leadership training and development.

BrightSpring’s stock declined 11.76% month-over-month but has risen roughly 42% since its IPO in January 2024. In September 2024, the company finalized its $60 million acquisition of Haven Hospice, a nonprofit provider in Florida, marking the company’s entry into Florida’s Certificate-of-Need (CON) market. As part of their integration efforts, it appears that BrightSpring will look to convert Haven to for-profit status.

The PACI’s 2.41% dip reflects a range of performances across the index as companies adapt their operations to new regulatory requirements and ongoing market pressures. In December, gains from companies like Addus were offset by mild turbulence in stock performance among its peers. Despite these adversities, companies in the PACI remain focused on resilience and strategic growth.

Conclusion

December capped a transformative year for the home health and post-acute care sectors. While reimbursement pressures and operational challenges persist, providers demonstrated resilience through strategic consolidations and realignments. The extended Amedisys-UNH merger timeline and emerging leadership initiatives, such as those from the Pennant Group, underscore the industry’s adaptability.

With the new Presidential Administration poised to prioritize home-based care, providers are well-positioned to navigate future changes. By focusing on high-quality, patient-centered care, the sector is set to seize opportunities for sustainable growth in 2025 and beyond.

Quote of the Month

“(Private equity) buyers will continue to flock to the hospice market regardless of increased regulatory scrutiny, with legitimate investors welcoming the oversight to help ensure they’re picking up quality assets.” – Tom Lillis, Partner of Stoneridge Partners Strategic Consulting

Read the Full Article Here: Hospice M&A Market to Return to Sanity in 2025

See Stoneridge’s Latest Blog:

Understanding the different types of buyers is crucial for sellers looking to find the best fit for their business. By identifying how each type of buyer aligns with their goals, sellers can position their business effectively, ensuring a smoother transaction process and maximizing value.

Read the Full Article Here: Who’s Buying? Exploring the Key Players in Home Health and Hospice Acquisitions

See It To Believe It!

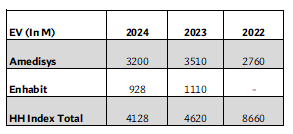

The Stoneridge Partners Home Health Index (HH Index) is updated monthly and measures the performance of these two publicly traded home health companies, all listed on the NASDAQ:

- Amedisys (AMED)

- Enhabit (EHAB)

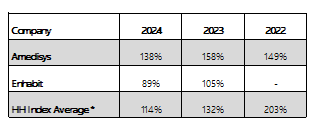

Here are the results of the stock prices for the past two years:

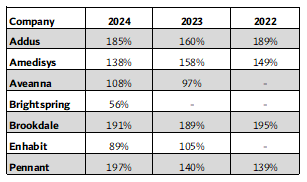

Enterprise Value (EV)

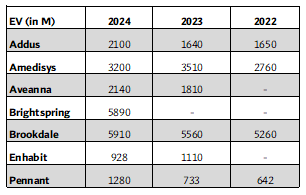

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

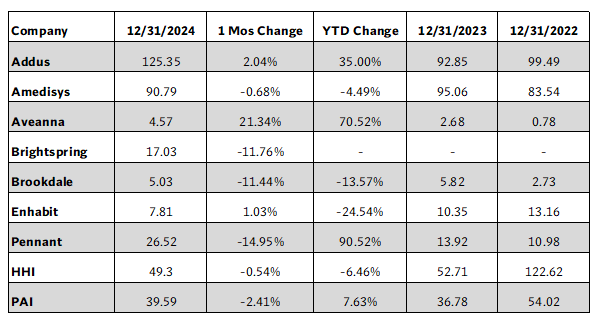

The Stoneridge Partners Post-Acute Care Index is updated monthly and measures the performance of these seven publicly traded post-acute care companies, all listed on the NASDAQ:

- Addus (ADUS)

- Amedisys (AMED)

- Aveanna (AVAH)

- Brightspring (BTSG)

- Brookdale Senior Living Inc. (BKD)

- Enhabit (EHAB)

- The Pennant Group, Inc. (PNTG)

Here are the results of the Post-Acute stock prices for the past two years:

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

This graph displays 24 months of Post-Acute Care Index performance.

The above calculations are based on selling price being defined as Enterprise Value (EV), with data provided by Yahoo Finance. Enterprise value is defined as market cap plus debt, minority interest and preferred shares, minus total cash and cash equivalents. EBITDA is calculated using methodology which may differ from that used by a company for its reporting. (Home Health Index December 2024 | Stoneridge Partners)

Recent Transactions From Around The Country

- PAX Health acquired Harris Psychiatry Services

- Levine Leichtman Capital Partners (LLCP) has acquired Synergy HomeCare

- Choice Health at Home has acquired Devotion Hospice

- Minnesota-headquartered St. Croix Hospice recently acquired Hospice of Siouxland in Iowa

- The Pennant Group acquired seven Signature Healthcare at Home locations in Oregon

SOLD by Stoneridge!!!

- Stoneridge Partners is proud to announce the successful sale of a Kentucky Behavioral Health agency.

View Stoneridge closed transactions on our Website.

Exclusively Listed For Sale By Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

4 adult care homes in Eastern NC. 99 beds licensed under adult care homes. CON status on this license category in NC. Some renovations needed,...

Non-skilled home care agency. $3.9M in revenue. 100% Medicaid. Long established (over 20 years).

Non-skilled home care agency. $3.7M in revenue. 100% Medicaid. 2 offices in major metro locations.

Medicaid home health provider in major Texas MSA. $1.9M of 2025 annualized revenue. 20-year history in the community. Quality staff in place.

Houston hospice provider. $1.3M in revenue with solid margins. No compliance issues, staff in place. Opportunity to expand into DFW area.

Multi-State Mental Health Services Provider. $2.75M in revenue. Efficient cost structure and consistent earnings. Proven scalable platform.

Fully licensed and accredited behavioral health clinic. Licensed for outpatient substance abuse and mental health therapy. Other license categories are easy to add. Credentialed with...

Medicaid wavier provider. Serving six counties in south central PA for 25+ years. Licensed to provide CHC, Attendant Care ACT 150, and OBRA Waivers. $262k...

Medicare-certified home health agency. $3.2M in LTM revenue. Medicaid programs comprise nearly 65% of the revenue. VA and private insurance. 4 locations serving 21 counties.

Hospice. 160+ ADC and growing. Multiple locations. No CAP issues.

Independent home health provider. $16.8M LTM in revenue with 13.1% EBITDA. Organic growth of 16.7% over the last 3 years. 44% traditional Medicare, 49% Medicare...

Medicare-certified home health agency. District 4. Accredited. No census.

Home care agency specializing in Medicaid family-supported services. $10M in revenue/$3M EBITDA. 10-year history. Locally acclaimed.

Medicare-certified home health agency. $15M+ in revenue. All skilled. Experienced leadership team. Accredited.

Home health and home care agency providing care to Medicare, Medicaid LTC Waiver, Pediatric and Advanced Neurological patients. $4.5M in revenue. AEBITDA of over 12%. ...

Hospice and IPU. $5.5M in revenue. Deep community ties in a major MSA. Highly dedicated and trained staff.

CHAP Accredited home health provider and hospice license. $5M+ in revenue. Great EBITDA margins in major Nevada MSA. Multiple specialty programs, great growth, and clean...

Home care company. $6M in revenue. Non-medical. Medicaid. Family Caregivers.

Home health & hospice. $10M in revenue. Great referral sources. Well-established. On HCHB.

Home care company. $7M in revenue. Private pay, non-medical. Accredited.

Medicare and Medicaid-certified home health agency. Approx. $400k in revenue. Central Arizona.

Professionally operated home health agency. $1.8M in revenue. 20% EBITDA margins. 20+ years in the Houston market.

Home care franchise. $1.3M in revenue. 13+ years in business. Large territory with growth potential.

Outpatient behavioral health provider. $4.5M+ in LTM revenue. Year-over-year revenue growth. Growth/expansion opportunities with a new location and new services. Licensed to serve a total...

Nurse registry. $7M in revenue. 100% private pay. Primarily non-medical home care. District 9.

Long-established Medicare/Medicaid home health agency with multiple locations. $7.3M in revenue. Good payor mix. On Homecare Homebase.

Home Health / Ohio / Popular

Home health agency in 2 states, one a CON. $3M+ in revenue. Good payor mix. 5-star patient survey rating.

Home Health / Multi-State / Popular

I/DD provider offering SCL & FHP services. $3M in revenue. Recent rate increase. Strong history in their community.

Behavioral health provider. $5.5M+ revenue with solid EBITDA margins. Leading edge service provider and with proprietary state contracts. Unique combination of service options and contracts...

Behavioral Health / Maryland / Popular

Medicaid/Medicare home health & home care company. $2.5M in revenue. Well-established. Stable revenue. Profitable year-over-year.

Home Health / Connecticut / Popular

Designer/Distributor of innovative, therapeutic, health and wellness personal products. $1.5M+ in revenue. Launched in the US and UK, now launching into the EU. Nearly 7,000...

Staffing Agency licensed to provide staffing services in 6 states. $ 2.4M+ in LTM revenue. Significant long-term contracts with providers in the Care-At-Home space, Health...

Other / Massachusetts / Popular

Homecare agency. $6.5M+ in revenue. Located on Long Island. Blend of Private Duty & Medicaid patients.

Maricopa County hospice. 40+ ADC. CHAP accredited. No CAP or regulatory issues.

Growing ABA (Autism) therapy clinic established in 2020. $1.6M in revenue. Market demand heavily outweighs supply in the area for ABA therapy.

Northeast Oklahoma home health company. $1.7M of revenue and profitable. 95% traditional Medicare. Long history in the area.

Home Health / Oklahoma / Popular

Special education and tutorial provider with limited access contracts. $3M in revenue. Strong relationships with county school programs. Long history in the community, close to...

Medicare-certified home health agency. $1.25M in revenue. AHCA accredited. Broward County (Region 10)

Home Health / Florida / Popular

Medicare-certified home health agency. Region 7, including sought-after Orange county (Orlando). Minimal census.

Home Health / Florida / Popular

Skilled home health agency. Servicing Central Florida for over 20 years. Census approximately 35.

Home Health / Florida / Popular

Occupational therapy practice with 2 offices in Southern California. Hand and upper extremity specialists. 20-plus years in the community. Strong referral relationships. Management and staff...

Other / California / Popular

$5M in revenue. Located in Northern/Richmond VA. Health system-owned Medicare home health. Growing organization.

Home Health / Popular

Medicare-certified home health. Opportunity to establish home health presence in Texas. Minimal census.

Home Health / Texas / Popular

Medicare/Medicaid-certified home health agency. $1.4M in revenue. District 9. Profitable. Accredited.

Home Health / Florida / Popular

Hospice. 45+ ADC. Rio Grande Valley. No CAP or regulatory issues.

$40M+ home care agency with 20+% AEBITDA. Primarily private-duty, non-medical (90%). Medicaid waiver programs. 40% family caregivers. Multiple locations.

Home Care / Pennsylvania / Popular

Home Health Index December 2024 | Stoneridge Partners

From Joe Lynch, Publisher of “Home Health Index.” Joe can be reached at [email protected] or (239) 561-0826, and toll-free at 800-218-3944. Previous editions of this monthly newsletter can be searched for at the bottom of the home page of the Home Health Index.

Joe Lynch, Partner and Managing Director at Stoneridge Partners brings over 30 years of healthcare expertise, specializing in mergers and acquisitions, finance, regulatory compliance, and business development. After earning his Business Administration degree from the University of Mississippi, Joe helped expand OrNda Healthcorp’s (now Tenet’s) home health care division.

In 1997, Joe founded Reachout Home Care, a Medicare and private duty agency, which he grew into three operating companies in Dallas and Houston before selling to Humana in 2014 using Stoneridge Partners. After the sale of his own company Joe joined Stoneridge, and for the last ten years has used his industry knowledge to help other owners list their companies and bring them to a successful close. With a proven track record in operations and M&A, Joe brings unmatched experience and

professionalism to every transaction.

For more information, please contact Joe directly at 214-394-0070 or [email protected]. All communications are confidential.