A new year is here, and for home health and post-acute care providers, it’s shaping up to be another eventful one. While many of the familiar pain points from 2024 are still present, there’s also plenty of room for optimism on the horizon.

The Home Health Index (HHI) and Post-Acute Care Index (PACI) both posted modest gains in January, with the former up 2.33% and the latter by 2.98%. Meanwhile, the S&P 500 was up 1.23% month-over-month.

With the Trump administration back in office, providers are keeping a close eye on potential policy shifts. Adjustments to Medicare and Medicaid reimbursement, including a review of the proposed 80-20 rule, remain a possibility.

The Centers for Medicare & Medicaid Services (CMS) announced a 4.3% increase in Medicare Advantage (MA) payments for 2026 that, if implemented, could be positive movement for home health providers with MA contracts in their payor mix, but again this will be something to keep tabs on with the new administration just coming into office.

Private equity remains a big player in healthcare, and it is expected that even more of these firms may look to enter the home-based healthcare sector in 2025, including making investments in home care, home health and hospice companies. While there had been growing regulatory scrutiny over Private Equity’s role in healthcare in the recent past, with the new administration in place, the home-based healthcare sector seemingly looks to be an attractive industry for new or continued investment.

“While it’s still very early in the year, we’re predicting a solid 2025” says Ben Bogan, partner and managing director at Stoneridge Partners. “With five deals already closed this year at Stoneridge, we’re seeing strong interest from Buyers that are looking for transactions to execute this year.”

Home Health Index

Coming into 2025, Amedisys halted the sale of approximately 130 of its home health and hospice locations to VitalCaring, adding further complexity to an already complicated process. This divestment was initially intended as a prerequisite for its merger with UnitedHealth.

UnitedHealth has also withdrawn its motion to dismiss the antitrust lawsuit filed against them by the Department of Justice (DOJ). The DOJ recently filed a response to the motion identifying specific geographical information where the proposed merger could reduce competition in the home-based care market, which prompted the decision by UnitedHealth. With the motion to dismiss withdrawn, the case can now move another step towards a potential trial.

Despite the potential roadblocks to its deal with UnitedHealth, Amedisys Inc. (NASDAQ: AMED) saw its stock rise 1.88% in January.

Meanwhile, Enhabit (NYSE: EHAB) recently earned a 2025 Great Place To Work Certification™ based on internal employee reviews.

“Receiving the Great Place To Work Certification™ is a testament to the relentless hard work and dedication of our Enhabit team members. Their unwavering commitment and daily contributions have been instrumental in building a positive work environment and fostering a strong company culture. This recognition truly belongs to them, and I couldn’t be more grateful for their efforts in making Enhabit a great place to work,” said Enhabit President and Chief Executive Officer Barb Jacobsmeyer.

Enhabit Inc. posted a 7.55% stock increase in January 2025.

Overall, the HHI’s 2.33% rise reflects cautious optimism as providers enter into the new year.

Post-Acute Care Index

BrightSpring Health Services (BTSG) led the PACI with a significant jump in its stock month-over-month, increasing 38.58%. This seems to follow the company announcement that it has entered a definitive agreement to divest its Community Living business to Sevita allowing them to focus on their other operations, including home health, hospice, and personal care services.

“In Sevita, we are pleased to partner with a new owner with extensive experience in the I/DD industry, who is well-suited to continue to provide compassionate care to the community living client population. With enhanced combined processes, technology, and overall capabilities, there are opportunities to share proven and innovative approaches that should advance possibilities for all constituents in this market. I believe both organizations will significantly benefit from amplified focus on core markets,” said BrightSpring President and CEO Jon Rousseau.

The Pennant Group (NASDAQ: PNTG) completed its acquisition of Signature Healthcare at Home’s home health and hospice assets early in the month.

Pennant’s CEO, Brent Guerisoli, noted “This is a substantial purchase that allows us to serve multiple new markets across Oregon and cements Pennant as one of the leading providers of home health and hospice in the Pacific Northwest. Following a record-breaking year in 2024, we are excited to continue the growth of our home health and hospice business in 2025.”

Although Pennant posted a slight 0.19% decrease month-over-month, they’re still up more than 75% versus a year ago.

Brookdale Senior Living (NYSE: BKD) saw a 7.95% dip in its stock price month-over-month. On December 3, 2024, Brookdale released a statement detailing a decision to not renew a master lease with Ventas, a Real Estate Investment Trust, that impacts 120 communities.

“(G)iven historical and expected future cash flow performance, non-renewal will be more positive to Brookdale from a cash flow standpoint beginning in 2026,” said CEO Cindy Baier.

Meanwhile, Aveanna Healthcare (NASDAQ: AVAH) recorded a 0.66% stock increase month-over-month.

The PACI’s 2.98% gain shows that while some post-acute care providers are making big moves, others are still working through challenges coming into 2025.

Conclusion

Lots of changes are seemingly on the horizon with a new administration in place, allowing for some uncertainty that will ultimately begin to take shape over the coming months. However, all signs seem to point toward favorable conditions for increased M&A activity in the home-based care space. With Buyers currently expressing strong interest in pursuing good targets for acquisition and M&A conditions looking favorable with the new administration, it is a great time for organizations to review and evaluate their short- and long-term goals.

Quote of the Month

“Everybody loves somebody the first six weeks; everybody celebrates the person who’s been there 20 years. But what about the two-year employee? If you look at your turnover numbers, that’s where you’re hurting. I promise you, if you really track one-year turnover or five-year turnover, that’s where you’re at risk.” – Andrew Molosky, CEO Chapters Health System

Read the Full Article Here: No One Left Behind: Building a Culture of Staff Retention in Hospice

Stoneridge In the News:

Strategies for Successful M&A: How and When Does it Make Sense for My Organization? This article was originally published on Ancor.org on 1/23/25. Co-written by; Dan Huckestein, VP & Associate Partner, and Peter Lynch, Associate Partner with Stoneridge Partners. Read the Full Article Here: Strategies for Successful M&A: How and When Does it Make Sense for My Organization?

Stoneridge Partners, Ben Bogan & Ted Cohen, provided sell-side M&A advisory services in the Community Based Care (CBC) and TLC At Home transaction. Read the Full Article Here: Stoneridge Partners, Ben Bogan and Ted Cohen, provided sell-side M&A advisory services in the Community Based Care (CBC) and TLC At Home transaction

Stoneridge Partners, Joe Lynch, provided sell-side M&A advisory services in the Christian Senior Care and New Day Healthcare transaction. Read the Full Article Here: Stoneridge Partners, Joe Lynch, provided sell-side M&A advisory services to Christian Senior Care Services in their transaction with New Day Healthcare

See It To Believe It!

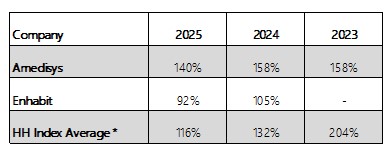

The Stoneridge Partners Home Health Index (HH Index) is updated monthly and measures the performance of these two publicly traded home health companies, all listed on the NASDAQ:

- Amedisys (AMED)

- Enhabit (EHAB)

Here are the results of the stock prices for the past two years:

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

The Stoneridge Partners Post-Acute Care Index is updated monthly and measures the performance of these seven publicly traded post-acute care companies, all listed on the NASDAQ:

- Addus (ADUS)

- Amedisys (AMED)

- Aveanna (AVAH)

- Brightspring (BTSG)

- Brookdale Senior Living Inc. (BKD)

- Enhabit (EHAB)

- The Pennant Group, Inc. (PNTG)

Here are the results of the Post-Acute stock prices for the past two years:

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

This graph displays 24 months of Post-Acute Care Index performance.

The above calculations are based on selling price being defined as Enterprise Value (EV), with data provided by Yahoo Finance. Enterprise value is defined as market cap plus debt, minority interest and preferred shares, minus total cash and cash equivalents. EBITDA is calculated using methodology which may differ from that used by a company for its reporting. (Home Health Index January 2025 | Stoneridge Partners)

Recent Transactions From Around The Country

- Family Matters In-Home Care acquired Homecare California

- Family Resource Home Care acquired Beneficial In-Home Care Inc.

- Bristol Hospice has acquired St. Agatha Comfort Care

SOLD by Stoneridge!!!

- Stoneridge Partners is proud to announce the successful sale of a Kentucky medical staffing agency

- Stoneridge Partners is proud to announce the successful sale of a Tennessee home health agency

View Stoneridge closed transactions on our Website.

Exclusively Listed For Sale By Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Non-skilled home care agency. $3.9M in revenue. 99% Medicaid. Long established (over 20 years).

Non-skilled home care agency. $3.7M in revenue. 100% Medicaid. 2 offices in major metro locations.

Medicaid home health provider in major Texas MSA. $1.9M of 2025 annualized revenue. 20-year history in the community. Quality staff in place.

Home Health / Texas / New

Houston hospice provider. $1.3M in revenue with solid margins. No compliance issues, staff in place. Opportunity to expand into DFW area.

Multi-State Mental Health Services Provider. $2.75M in revenue. Efficient cost structure and consistent earnings. Proven scalable platform.

Fully licensed and accredited behavioral health clinic. Licensed for outpatient substance abuse and mental health therapy. Other license categories are easy to add. Credentialed with...

Medicaid wavier provider. Serving six counties in south central PA for 25+ years. Licensed to provide CHC, Attendant Care ACT 150, and OBRA Waivers. $262k...

Medicare-certified home health agency. $3.2M in LTM revenue. Medicaid programs comprise nearly 65% of the revenue. VA and private insurance. 4 locations serving 21 counties.

Hospice. 160+ ADC and growing. Multiple locations. No CAP issues.

Independent home health provider. $16.8M LTM in revenue with 13.1% EBITDA. Organic growth of 16.7% over the last 3 years. 44% traditional Medicare, 49% Medicare...

Medicare-certified home health agency. District 4. Accredited. No census.

Home care agency specializing in Medicaid family-supported services. $10M in revenue/$3M EBITDA. 10-year history. Locally acclaimed.

Medicare-certified home health agency. $15M+ in revenue. All skilled. Experienced leadership team. Accredited.

Home health and home care agency providing care to Medicare, Medicaid LTC Waiver, Pediatric and Advanced Neurological patients. $4.5M in revenue. AEBITDA of over 12%. ...

Hospice and IPU. $5.5M in revenue. Deep community ties in a major MSA. Highly dedicated and trained staff.

CHAP Accredited home health provider and hospice license. $5M+ in revenue. Great EBITDA margins in major Nevada MSA. Multiple specialty programs, great growth, and clean...

Home care company. $6M in revenue. Non-medical. Medicaid. Family Caregivers.

Home health & hospice. $10M in revenue. Great referral sources. Well-established. On HCHB.

Home care company. $7M in revenue. Private pay, non-medical. Accredited.

Medicare and Medicaid-certified home health agency. Approx. $400k in revenue. Central Arizona.

Professionally operated home health agency. $1.8M in revenue. 20% EBITDA margins. 20+ years in the Houston market.

Home care franchise. $1.3M in revenue. 13+ years in business. Large territory with growth potential.

Outpatient behavioral health provider. $4.5M+ in LTM revenue. Year-over-year revenue growth. Growth/expansion opportunities with a new location and new services. Licensed to serve a total...

Nurse registry. $7M in revenue. 100% private pay. Primarily non-medical home care. District 9.

Medicare-certified home health agency. DFW area. No census.

Long-established Medicare/Medicaid home health agency with multiple locations. $7.3M in revenue. Good payor mix. On Homecare Homebase.

Home Health / Ohio / Popular

Home health agency in 2 states, one a CON. $3M+ in revenue. Good payor mix. 5-star patient survey rating.

Home Health / Multi-State / Popular

I/DD provider offering SCL & FHP services. $3M in revenue. Recent rate increase. Strong history in their community.

Behavioral health provider. $5.5M+ revenue with solid EBITDA margins. Leading edge service provider and with proprietary state contracts. Unique combination of service options and contracts...

Behavioral Health / Maryland / Popular

Medicaid/Medicare home health & home care company. $2.5M in revenue. Well-established. Stable revenue. Profitable year-over-year.

Home Health / Connecticut / Popular

Designer/Distributor of innovative, therapeutic, health and wellness personal products. $1.5M+ in revenue. Launched in the US and UK, now launching into the EU. Nearly 7,000...

Staffing Agency licensed to provide staffing services in 6 states. $ 2.4M+ in LTM revenue. Significant long-term contracts with providers in the Care-At-Home space, Health...

Other / Massachusetts / Popular

Homecare agency. $6.5M+ in revenue. Located on Long Island. Blend of Private Duty & Medicaid patients.

Maricopa County hospice. 40+ ADC. CHAP accredited. No CAP or regulatory issues.

Growing ABA (Autism) therapy clinic established in 2020. $1.6M in revenue. Market demand heavily outweighs supply in the area for ABA therapy.

Northeast Oklahoma home health company. $1.7M of revenue and profitable. 95% traditional Medicare. Long history in the area.

Home Health / Oklahoma / Popular

Special education and tutorial provider with limited access contracts. $3M in revenue. Strong relationships with county school programs. Long history in the community, close to...

Medicare-certified home health agency. $1.25M in revenue. AHCA accredited. Broward County (Region 10)

Home Health / Florida / Popular

Medicare-certified home health agency. Region 7, including sought-after Orange county (Orlando). Minimal census.

Home Health / Florida / Popular

Skilled home health agency. Servicing Central Florida for over 20 years. Census approximately 35.

Home Health / Florida / Popular

Occupational therapy practice with 2 offices in Southern California. Hand and upper extremity specialists. 20-plus years in the community. Strong referral relationships. Management and staff...

Other / California / Popular

$5M in revenue. Located in Northern/Richmond VA. Health system-owned Medicare home health. Growing organization.

Home Health / Popular

Medicare-certified home health. Opportunity to establish home health presence in Texas. Minimal census.

Home Health / Texas / Popular

Medicare/Medicaid-certified home health agency. $1.4M in revenue. District 9. Profitable. Accredited.

Home Health / Florida / Popular

Hospice. 45+ ADC. Rio Grande Valley. No CAP or regulatory issues.

$40M+ home care agency with 20+% AEBITDA. Primarily private-duty, non-medical (90%). Medicaid waiver programs. 40% family caregivers. Multiple locations.

Home Care / Pennsylvania / Popular

Home Health Index January 2025 | Stoneridge Partners

From Ben Bogan, Publisher of “Home Health Index.” Ben can be reached at [email protected] or (239) 561-0826, and toll-free at 800-218-3944. Previous editions of this monthly newsletter can be searched for at the bottom of the home page of the Home Health Index.

Ben Bogan, J.D., Partner and Managing Director at Stoneridge Partners, has been a leading figure in healthcare M&A since 2014, specializing in home health, home care, and hospice transactions. With over 70 successful closed deals, Ben’s experience and expertise have set him apart as a skilled and invaluable intermediary in the industry.

With a law degree from Albany Law School, a BSBA in Economics from the University of Florida, and his background as a former Assistant District Attorney and Assistant District Counsel for the U.S. Army Corps of Engineers, Ben combines his legal background and M&A expertise to deliver exceptional results in every transaction. Available to his clients 24/7, Ben builds strong relationships with his clients and has garnered rave reviews.

For more information, please contact Ben directly at 520-991-4653 or [email protected]. All communications are confidential.