Introduction

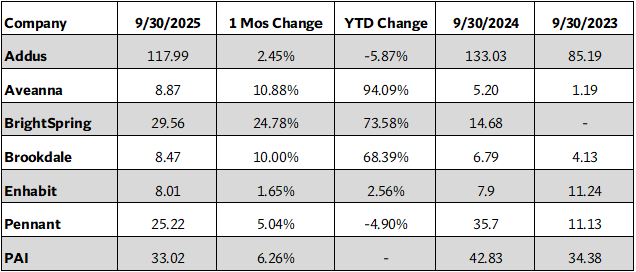

In September 2025, the S&P 500 rose 3.53% month-over-month (MoM), bringing its year-to-date (YTD) gain to 13.72%. The Post Acute Care Index also increased, climbing 6.26% MoM.

The Federal Reserve cut interest rates by 0.25% on September 17, which is the first rate cut since December 2024. This cut reduced the federal funds rate to between 4% and 4.25%, down from the previous 4.25% – 5% range. While the Fed has projected two more 0.25% cuts in 2025 and another in 2026, future policy decisions will depend on macroeconomic factors such as inflation and unemployment through the remainder of 2025.

The U.S. Government entered a shutdown on October 1, with lawmakers unable to agree on a funding package for the new fiscal year. The primary disagreements centered on extending subsidies provided under the Affordable Care Act (ACA) and proposed modifications to Medicaid spending. Several budget proposals were introduced on either side of the aisle, but none secured enough votes in the Senate to advance. The last government shutdown occurred on December 22, 2018, and lasted 35 days, making it the longest shutdown in U.S. history.

“Global tariff negotiations, shifts in fiscal and monetary policy, and ongoing regulatory changes continue to be issues at hand,” said Ben Bogan, Partner and Managing Director at Stoneridge Partners. “Even so, we continue to see strong buyer interest in strategic acquisitions, alongside informed sellers who are ready to explore the next step for their businesses.”

Post Acute Care Index (PAI)

In September, Enhabit posted a 1.65% MoM increase in stock price and is up 2.56% YTD. In its second quarter financial results, the company announced total net service revenue of $266.1 million, a 2.1% increase from $260.6 million in Q2 2024. Like several companies in the PAI, Enhabit recently presented at the Jeffries 2025 Healthcare Services Conference where it highlighted the opening of one new home health and three new hospice sites thus far in 2025, putting the company on track to reach its goal of 10 de novo locations for the year.

Brookdale saw a 10% MoM increase in stock price during the month, bringing its YTD gain to 68.39%. The company recently announced that Nick Stengle will succeed Denise W. Warren as Chief Executive Officer, effective October 6, 2025. Warren, who has served as Interim CEO since April 2025, will return to her role as Non-Executive Chairman of the Board once Stengle assumes the position. “Brookdale has a strong foundation in place with compelling long-term growth drivers, and I believe the Company is well positioned to extend its leadership position in the industry as we enter the next chapter and capitalize on attractive industry demographics,” said Stengle. “I look forward to building on the Company’s recent success and to capturing the significant opportunities ahead to drive shareholder value.”

The Pennant Group’s stock price rose 5.04% MoM in September and is down 4.90% YTD. Early in the month, the company announced its acquisition of Healing Hearts Home Health and Healing Hearts Outpatient Therapy in eastern Wyoming. Both businesses will retain the Healing Hearts name and serve the Gillette and Moorcroft communities as part of Pennant’s expanding regional network.

Additionally, Pennant is acquiring 54 divested home health, hospice, and personal care locations across Tennessee, Georgia, and Alabama from UnitedHealth and Amedisys for $146.5 million. The closing of the Amedisys–UnitedHealth merger was contingent on the divestiture of 164 home health and hospice locations across 19 states, as required by an antitrust settlement issued by the Department of Justice. BrightSpring Health Services is also set to acquire a portion of these divested locations. According to CEO Brent Guerisoli, “This marks an exciting new chapter in Pennant’s growth journey. Entering the Southeast is a strategic move for us, and we do so from a position of strength, building on proven leadership, operational excellence, and a clear vision for the future. This acquisition opens the door for emerging leaders in this new region to grow within Pennant’s innovative platform.”

Conclusion

September was marked by meaningful developments across the broader economy and the home health and hospice sectors, with interest rate cuts, government spending debates, and major M&A divestitures shaping the landscape. Despite ongoing uncertainty surrounding fiscal policy and regulatory changes, buyer appetite for quality providers has remained strong. With demand for home-based care continuing to expand and providers actively pursuing strategic acquisitions, the industry is well positioned for sustained M&A activity in the months ahead.

Quote of the Month

“Rural communities are the bedrock of America. They have waited too long for Washington to act. Now, at last, we are acting with the largest investment ever made to improve health care for rural Americans. This $50 billion program is about delivering dignity and dependable care to rural communities, making sure every American has access to affordable, high-quality treatment.”

– U.S. Health and Human Services Secretary Robert F. Kennedy, Jr.

Read the Full Article Here: CMS Launches Landmark $50 Billion Rural Health Transformation Program

Stoneridge In the News:

Understanding Platform Acquisitions in Home Health & Hospice Mergers and Acquisitions (M&A) Read the Full Article Here – Blog written by Partner & Managing Director Ben Bogan.

See It To Believe It!

The Stoneridge Partners Post-Acute Care Index is updated monthly and measures the performance of these six publicly traded post-acute care companies, all listed on the NASDAQ:

- Addus (ADUS)

- Aveanna (AVAH)

- BrightSpring (BTSG)

- Brookdale Senior Living Inc. (BKD)

- Enhabit (EHAB)

- The Pennant Group, Inc. (PNTG)

Here are the results of the Post-Acute stock prices for the past two years:

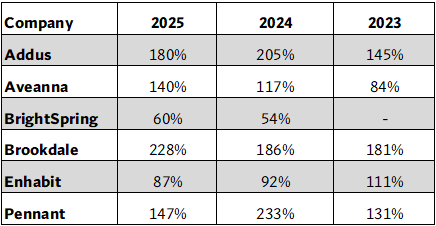

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

The above calculations are based on the selling price being defined as Enterprise Value (EV), with data provided by Yahoo Finance. Enterprise value is defined as market cap plus debt, minority interest, and preferred shares, minus total cash and cash equivalents. EBITDA is calculated using a methodology that may differ from that used by a company for its reporting. (Home Health Index September 2025 | Stoneridge Partners)

Recent Transactions From Around The Country

- LifeCare Home Health acquired St. Gabriel’s Hospice

- Uplift Hospice acquired Stoneridge Hospice

- VIA Health Partners acquired Equity Health

SOLD by Stoneridge!!!

- Stoneridge Partners is proud to announce the successful sale of a Texas home care agency.

- Stoneridge Partners is proud to announce the successful sale of a New Mexico home care agency.

- Stoneridge Partners is proud to announce the successful sale of a California behavioral health agency.

View Stoneridge closed transactions on our Website.

Exclusively Listed For Sale By Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Home care agency. $16M+ revenue. 100% Medicaid-reimbursed. Approx. 50% skilled/50% non-medical. Medicare-certified.

Home health agency. $3M in revenue. 75% Medicaid, but Medicare Certification as well. Long history of success.

4 adult care homes in Eastern NC. 99 beds licensed under adult care homes. CON status on this license category in NC. Some renovations needed,...

Non-skilled home care agency. $3.7M in revenue. 100% Medicaid. 2 offices in major metro locations.

Medicaid home health provider in major Texas MSA. $1.9M of 2025 annualized revenue. 20-year history in the community. Quality staff in place.

Houston hospice provider. $1.3M in revenue with solid margins. No compliance issues, staff in place. Opportunity to expand into DFW area.

Multi-State Mental Health Services Provider. $2.75M in revenue. Efficient cost structure and consistent earnings. Proven scalable platform.

Fully licensed and accredited behavioral health clinic. Licensed for outpatient substance abuse and mental health therapy. Other license categories are easy to add. Credentialed with...

Medicaid wavier provider. Serving six counties in south central PA for 25+ years. Licensed to provide CHC, Attendant Care ACT 150, and OBRA Waivers. $262k...

Medicare-certified home health agency. $3.2M in LTM revenue. Medicaid programs comprise nearly 65% of the revenue. VA and private insurance. 4 locations serving 21 counties.

Hospice. 160+ ADC and growing. Multiple locations. No CAP issues.

Independent home health provider. $16.8M LTM in revenue with 13.1% EBITDA. Organic growth of 16.7% over the last 3 years. 44% traditional Medicare, 49% Medicare...

Medicare-certified home health agency. District 4. Accredited. No census.

Home care agency specializing in Medicaid family-supported services. $10M in revenue/$3M EBITDA. 10-year history. Locally acclaimed.

Medicare-certified home health agency. $15M+ in revenue. All skilled. Experienced leadership team. Accredited.

Home health and home care agency providing care to Medicare, Medicaid LTC Waiver, Pediatric and Advanced Neurological patients. $4.5M in revenue. AEBITDA of over 12%. ...

Hospice and IPU. $5.5M in revenue. Deep community ties in a major MSA. Highly dedicated and trained staff.

Home care company. $6M in revenue. Non-medical. Medicaid. Family Caregivers.

Home health & hospice. $10M in revenue. Great referral sources. Well-established. On HCHB.

Home care company. $7M in revenue. Private pay, non-medical. Accredited.

Medicare and Medicaid-certified home health agency. Approx. $400k in revenue. Central Arizona.

Professionally operated home health agency. $1.8M in revenue. 20% EBITDA margins. 20+ years in the Houston market.

Home care franchise. $1.3M in revenue. 13+ years in business. Large territory with growth potential.

Outpatient behavioral health provider. $4.5M+ in LTM revenue. Year-over-year revenue growth. Growth/expansion opportunities with a new location and new services. Licensed to serve a total...

Nurse registry. $7M in revenue. 100% private pay. Primarily non-medical home care. District 9.

Long-established Medicare/Medicaid home health agency with multiple locations. $7.3M in revenue. Good payor mix. On Homecare Homebase.

Home Health / Ohio / Popular

Home health agency in 2 states, one a CON. $3M+ in revenue. Good payor mix. 5-star patient survey rating.

Home Health / Multi-State / Popular

I/DD provider offering SCL & FHP services. $3M in revenue. Recent rate increase. Strong history in their community.

Behavioral health provider. $5.5M+ revenue with solid EBITDA margins. Leading edge service provider and with proprietary state contracts. Unique combination of service options and contracts...

Behavioral Health / Maryland / Popular

Medicaid/Medicare home health & home care company. $2.5M in revenue. Well-established. Stable revenue. Profitable year-over-year.

Home Health / Connecticut / Popular

Designer/Distributor of innovative, therapeutic, health and wellness personal products. $1.5M+ in revenue. Launched in the US and UK, now launching into the EU. Nearly 7,000...

Staffing Agency licensed to provide staffing services in 6 states. $ 2.4M+ in LTM revenue. Significant long-term contracts with providers in the Care-At-Home space, Health...

Other / Massachusetts / Popular

Homecare agency. $6.5M+ in revenue. Located on Long Island. Blend of Private Duty & Medicaid patients.

Maricopa County hospice. 40+ ADC. CHAP accredited. No CAP or regulatory issues.

Growing ABA (Autism) therapy clinic established in 2020. $1.6M in revenue. Market demand heavily outweighs supply in the area for ABA therapy.

Northeast Oklahoma home health company. $1.7M of revenue and profitable. 95% traditional Medicare. Long history in the area.

Home Health / Oklahoma / Popular

Special education and tutorial provider with limited access contracts. $3M in revenue. Strong relationships with county school programs. Long history in the community, close to...

Medicare-certified home health agency. $1.25M in revenue. AHCA accredited. Broward County (Region 10)

Home Health / Florida / Popular

Medicare-certified home health agency. Region 7, including sought-after Orange county (Orlando). Minimal census.

Home Health / Florida / Popular

$5M in revenue. Located in Northern/Richmond VA. Health system-owned Medicare home health. Growing organization.

Home Health / Popular

Medicare/Medicaid-certified home health agency. $1.4M in revenue. District 9. Profitable. Accredited.

Home Health / Florida / Popular

Hospice. 45+ ADC. Rio Grande Valley. No CAP or regulatory issues.

$40M+ home care agency with 20+% AEBITDA. Primarily private-duty, non-medical (90%). Medicaid waiver programs. 40% family caregivers. Multiple locations.

Home Care / Pennsylvania / Popular

Home Health Index September 2025 | Stoneridge Partners

From Ben Bogan, Publisher of “Home Health Index.” Ben can be reached at [email protected] or (239) 561-0826, and toll-free at 800-218-3944. Previous editions of this monthly newsletter can be searched for at the bottom of the home page of the Home Health Index.

Ben Bogan, J.D., Partner and Managing Director at Stoneridge Partners, has been a leading figure in healthcare M&A since 2014, specializing in home health, home care, and hospice transactions. With over 70 successful closed deals, Ben’s experience and expertise have set him apart as a skilled and invaluable intermediary in the industry.

With a law degree from Albany Law School, a BSBA in Economics from the University of Florida, and his background as a former Assistant District Attorney and Assistant District Counsel for the U.S. Army Corps of Engineers, Ben combines his legal background and M&A expertise to deliver exceptional results in every transaction. Available to his clients 24/7, Ben builds strong relationships with his clients and has garnered rave reviews.

For more information, please contact Ben directly at 520-991-4653 or [email protected]. All communications are confidential.