Introduction

February 2025 saw mixed results for the home health and post-acute care sectors. The S&P 500 recorded a mild 0.01% increase month-over-month and a 1.24% gain year-to-date, reflecting a slightly more stable market performance compared to the 0.53% month-over-month decline in the Home Health Index (HHI). Meanwhile, the Post-Acute Care Index (PAI) saw a 13.04% decline month-over-month and a 10.45% drop year-to-date.

Regulatory developments continued to shape the industry during the month. The Trump administration suspended the Hospice Special Focus Program (SFP) to ease compliance burdens, while Robert F. Kennedy Jr. assumed his role as Secretary of Health and Human Services (HHS), sparking speculation about future healthcare policies.

UnitedHealth Group (UHG) continues to navigate the ongoing antitrust lawsuit surrounding the proposed acquisition of Amedisys. UHG has withdrawn its motion to dismiss the case after the Department of Justice (DOJ) identified specific geographic areas where the merger could reduce competition, likely setting the stage for a trial. While many details pertaining to the case remain unclear, the resolution of a future trial may have consequences for larger consolidation efforts in the future.

Stoneridge Partners, Partner and Managing Director, Joe Lynch explained, “As the new administration begins to settle in and regulatory developments continue to take shape, M&A activity in the home health and post-acute care space remains strong. Strategic buyers and private equity continue to seek growth opportunities, driven in part by rising public demand for home-based care. As providers focus on both organic and acquisitive growth, we expect a competitive deal environment throughout 2025.”

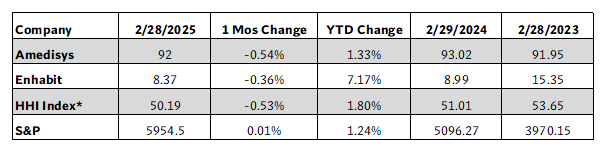

Home Health Index (HHI) Performance

Amedisys posted a 0.54% stock decline month-over-month, though it remains up 1.33% year-to-date, demonstrating resilience despite hurdles related to its proposed acquisition by UHG. The company remains at the center of the DOJ’s antitrust lawsuit against UHG’s $3.3 billion acquisition, which continues to draw national attention. Despite these challenges, Amedisys continues to experience steady home health growth, reinforcing its standing as a key industry player.

Enhabit recorded a 0.36% stock decline month-over-month in February but remains up 7.17% year-to-date, highlighting continued investor confidence. Enhabit’s Board of Directors appears to believe that its recent nomination of Stephan Rodgers to stand for election to its Board would strengthen its leadership and enhance their long-term strategic vision. In support, Chairman of the Board Jeff Bolton stated, “We look forward to Steve joining us as a director and we believe our stockholders will agree that he brings strong, relevant industry expertise to our board. Steve’s 25 years of executive-level experience in building companies of scale, including in the home health and hospice industry, will give him a unique perspective as our board oversees management’s execution of our long-term strategies.”

Post-Acute Care (PAI) Index Performance

In February 2025, Addus saw a 23.48% decline in stock value month-over-month, essentially mirroring its 23.60% decrease year-to-date. Concerns over Medicaid reimbursement shifts and market-wide clinical staffing shortages continue to be on the minds of providers across the industry, but Addus appears to be meeting these challenges through caregiver hiring improvements and strategic expansion initiatives. The company reported 7.5% year-over-year revenue growth in Q4 2024 vs Q4 2023. In addition, Addus’ $350 million acquisition of Gentiva’s personal care operations in December 2024 expanded its presence in the personal care market. Dirk Allison, Chairman and Chief Executive Officer of Addus, stated, “This important acquisition aligns with our strategy to build scale in existing markets as well as enter select new markets where we can immediately establish a significant personal care presence.”

Pennant posted a 13.98% stock decline month-over-month and a 14.14% decrease year-to-date, reflecting some of the volatility seen in the greater Healthcare market. However, the company remains committed to strategic acquisitions and leadership development to sustain growth. Reflecting on the company’s previous performance heading into 2025, Pennant Group CEO Brent Guerisoli noted, “2024 was also a year of transformative expansion, including numerous strategic acquisitions and robust organic growth. With our solid operational foundation, ongoing investments in leadership, and abundant latent potential in our new and existing operations, we anticipate continued positive momentum in 2025 and beyond.”

BrightSpring’s stock declined 18.31% month-over-month, though it remains up 13.21% year-to-date. On January 20, 2025, BrightSpring entered into a definitive agreement to divest its Community Living business to Sevita for $835 million. Regarding the pending acquisition, Philip Kaufman, CEO of Sevita stated “We look forward to welcoming ResCare Community Living’s talented and experienced team to Sevita. Together, we will be positioned to support more people in need of these impactful services, deploy learnings and best practices from both organizations, and make continued investments in our homes, service delivery and technology – all with the goal of enhancing the lives of the individuals that we are privileged to serve.” The divestiture to Sevita is expected to close sometime in 2025.

Brookdale was February’s top-performing PAI company, with a 23.11% increase month-over-month and 13.32% year-to-date. Brookdale recently confirmed receipt of 6 new director nominations from Pangaea Ventures, L.P., a fund managed by Ortelius Advisors, L.P. The election will be held at Brookdale’s 2025 Annual Meeting of Stockholders, though the date of the meeting has not yet been announced.

Conclusion & Market Outlook

The home health and post-acute care sectors continue to evolve, adapting to regulatory shifts, reimbursement challenges, and varying degrees of market volatility. With the potential implementation of new healthcare policies under the Trump administration in 2025, refining reimbursement models and tracking compliance regulations will remain a priority for providers. Strong M&A activity is expected to continue through 2025 as companies seek to expand market share and optimize service offerings within a shifting environment.

Quote of the Month

“Caring for an elderly or disabled family member can be overwhelming, and many families are not prepared to provide the necessary level of care. Making the decision to place a loved one in a long-term care facility can be heartbreaking, and these facilities are often prohibitively expensive, leaving families feeling overwhelmed and unprepared.” – Kelsie Reed Blakeney, founder of Ablake Healthcare in Columbia, South Carolina

Read the Full Article Here: Offering Care That Gives Back: From Critical Care Nurse To Home Health Care CEO

Stoneridge In the News:

How Long Does It Take to Sell a Home Health Agency of Hospice? Read the Full Article Here – Blog written by Partner & Managing Director Ben Bogan.

Stoneridge Partners, Joe Lynch and John Parks, provided sell-side M&A advisory services to a home health company in Texas. Read the Full Article Here

Stoneridge Partners, Ben Bogan & Ted Cohen, provided sell-side M&A advisory services in the Community Based Care (CBC) and TLC At Home transaction. Read the Full Article Here

Stoneridge Partners, Joe Lynch, provided sell-side M&A advisory services in the Christian Senior Care and New Day Healthcare transaction. Read the Full Article Here

See It To Believe It!

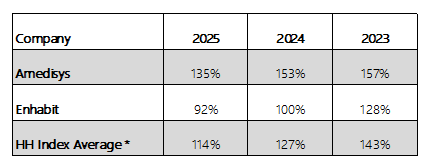

The Stoneridge Partners Home Health Index (HH Index) is updated monthly and measures the performance of these two publicly traded home health companies, all listed on the NASDAQ:

- Amedisys (AMED)

- Enhabit (EHAB)

Here are the results of the stock prices for the past two years:

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

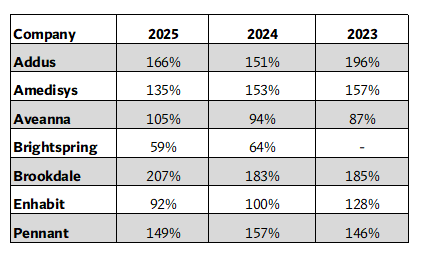

The Stoneridge Partners Post-Acute Care Index is updated monthly and measures the performance of these seven publicly traded post-acute care companies, all listed on the NASDAQ:

- Addus (ADUS)

- Amedisys (AMED)

- Aveanna (AVAH)

- Brightspring (BTSG)

- Brookdale Senior Living Inc. (BKD)

- Enhabit (EHAB)

- The Pennant Group, Inc. (PNTG)

Here are the results of the Post-Acute stock prices for the past two years:

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

This graph displays 24 months of Post-Acute Care Index performance.

The above calculations are based on selling price being defined as Enterprise Value (EV), with data provided by Yahoo Finance. Enterprise value is defined as market cap plus debt, minority interest and preferred shares, minus total cash and cash equivalents. EBITDA is calculated using methodology which may differ from that used by a company for its reporting. (Home Health Index February 2025 | Stoneridge Partners)

Recent Transactions From Around The Country

- BrightStar Care has been acquired by an affiliate of Peak Rock Capital

- New Day Healthcare has acquired the home health agency Patient Recovery Home Healthcare Services in Houston.

- Wysa, an AI-powered mental health chatbot company, has acquired April Health, a behavioral health company that partners with primary care providers.

- Uplift Hospice has acquired Star of Texas Hospice.

- Gracepoint Home Care has acquired the assets of Touching Hearts Senior Care.

- FullBloom, an academic, behavioral and mental health provider for schools, acquired school-based mental health provider CharacterStrong.

SOLD by Stoneridge!!!

- Stoneridge Partners is proud to announce the successful sale of a Texas home health agency.

- Stoneridge Partners is proud to announce the successful sale of a Texas home care agency.

- Stoneridge Partners is proud to announce the successful sale of a North Carolina home care agency.

View Stoneridge closed transactions on our Website.

Exclusively Listed For Sale By Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Non-skilled home care and adult day services. $3.3M in revenue. Certificate of Need. 75% Medicaid.

Mental health counseling & therapy center. $1M in revenue. Long-established practice with excellent reputation.

Home care company. $7M in revenue. 20%+ AEBITDA. 90%+ non-medical. Primarily auto-injury related/long-term clients. Payor sources are mainly auto insurers.

Fully licensed and accredited SUD clinic. $3.5M in annual revenue. Operating continuously for over 40 years. 2 locations with residential and outpatient services.

Home care agency. $16M+ revenue. 100% Medicaid-reimbursed. Approx. 50% skilled/50% non-medical. Medicare-certified.

Home health agency. $3M in revenue. 75% Medicaid, but Medicare Certification as well. Long history of success.

4 adult care homes in Eastern NC. 99 beds licensed under adult care homes. CON status on this license category in NC. Some renovations needed,...

Non-skilled home care agency. $3.7M in revenue. 100% Medicaid. 2 offices in major metro locations.

Medicaid home health provider in major Texas MSA. $1.9M of 2025 annualized revenue. 20-year history in the community. Quality staff in place.

Multi-State Mental Health Services Provider. $2.75M in revenue. Efficient cost structure and consistent earnings. Proven scalable platform.

Fully licensed and accredited behavioral health clinic. Licensed for outpatient substance abuse and mental health therapy. Other license categories are easy to add. Credentialed with...

Medicaid wavier provider. Serving six counties in south central PA for 25+ years. Licensed to provide CHC, Attendant Care ACT 150, and OBRA Waivers. $262k...

Medicare-certified home health agency. $3.2M in LTM revenue. Medicaid programs comprise nearly 65% of the revenue. VA and private insurance. 4 locations serving 21 counties.

Hospice. 160+ ADC and growing. Multiple locations. No CAP issues.

Independent home health provider. $16.8M LTM in revenue with 13.1% EBITDA. Organic growth of 16.7% over the last 3 years. 44% traditional Medicare, 49% Medicare...

Home care agency specializing in Medicaid family-supported services. $10M in revenue/$3M EBITDA. 10-year history. Locally acclaimed.

Medicare-certified home health agency. $15M+ in revenue. All skilled. Experienced leadership team. Accredited.

Home health and home care agency providing care to Medicare, Medicaid LTC Waiver, Pediatric and Advanced Neurological patients. $4.5M in revenue. AEBITDA of over 12%. ...

Hospice and IPU. $5.5M in revenue. Deep community ties in a major MSA. Highly dedicated and trained staff.

Home care company. $6M in revenue. Non-medical. Medicaid. Family Caregivers.

Home Care / Pennsylvania / Popular

Home health & hospice. $10M in revenue. Great referral sources. Well-established. On HCHB.

Home care company. $7M in revenue. Private pay, non-medical. Accredited.

Medicare and Medicaid-certified home health agency. Approx. $400k in revenue. Central Arizona.

Professionally operated home health agency. $1.8M in revenue. 20% EBITDA margins. 20+ years in the Houston market.

Home Health / Texas / Popular

Home care franchise. $1.3M in revenue. 13+ years in business. Large territory with growth potential.

Outpatient behavioral health provider. $4.5M+ in LTM revenue. Year-over-year revenue growth. Growth/expansion opportunities with a new location and new services. Licensed to serve a total...

Behavioral Health / Pennsylvania / Popular

Nurse registry. $7M in revenue. 100% private pay. Primarily non-medical home care. District 9.

Long-established Medicare/Medicaid home health agency with multiple locations. $7.3M in revenue. Good payor mix. On Homecare Homebase.

Home Health / Ohio / Popular

Home health agency in 2 states, one a CON. $3M+ in revenue. Good payor mix. 5-star patient survey rating.

Home Health / Multi-State / Popular

I/DD provider offering SCL & FHP services. $3M in revenue. Recent rate increase. Strong history in their community.

Behavioral health provider. $5.5M+ revenue with solid EBITDA margins. Leading edge service provider and with proprietary state contracts. Unique combination of service options and contracts...

Behavioral Health / Maryland / Popular

Medicaid/Medicare home health & home care company. $2.4M in revenue. Well-established. Stable revenue. Profitable year-over-year.

Home Health / Connecticut / Popular

Designer/Distributor of innovative, therapeutic, health and wellness personal products. $1.5M+ in revenue. Launched in the US and UK, now launching into the EU. Nearly 7,000...

Staffing Agency licensed to provide staffing services in 6 states. $ 2.4M+ in LTM revenue. Significant long-term contracts with providers in the Care-At-Home space, Health...

Other / Massachusetts / Popular

Homecare agency. $6.5M+ in revenue. Located on Long Island. Blend of Private Duty & Medicaid patients.

Maricopa County hospice. 40+ ADC. CHAP accredited. No CAP or regulatory issues.

Growing ABA (Autism) therapy clinic established in 2020. $1.6M in revenue. Market demand heavily outweighs supply in the area for ABA therapy.

Northeast Oklahoma home health company. $1.7M of revenue and profitable. 95% traditional Medicare. Long history in the area.

Home Health / Oklahoma / Popular

Special education and tutorial provider with limited access contracts. $3M in revenue. Strong relationships with county school programs. Long history in the community, close to...

Medicare-certified home health agency. $1.25M in revenue. AHCA accredited. Broward County (Region 10)

Home Health / Florida / Popular

Medicare-certified home health agency. Region 7, including sought-after Orange county (Orlando). Minimal census.

Home Health / Florida / Popular

$5M in revenue. Located in Northern/Richmond VA. Health system-owned Medicare home health. Growing organization.

Home Health / Popular

Hospice. 45+ ADC. Rio Grande Valley. No CAP or regulatory issues.

$40M+ home care agency with 20+% AEBITDA. Primarily private-duty, non-medical (90%). Medicaid waiver programs. 40% family caregivers. Multiple locations.

Home Care / Pennsylvania / Popular

Home Health Index February 2025 | Stoneridge Partners

From Joe Lynch, Publisher of “Home Health Index.” Joe can be reached at [email protected] or (239) 561-0826, and toll-free at 800-218-3944. Previous editions of this monthly newsletter can be searched for at the bottom of the home page of the Home Health Index.

Joe Lynch, Partner and Managing Director at Stoneridge Partners brings over 30 years of healthcare expertise, specializing in mergers and acquisitions, finance, regulatory compliance, and business development. After earning his Business Administration degree from the University of Mississippi, Joe helped expand OrNda Healthcorp’s (now Tenet’s) home health care division.

In 1997, Joe founded Reachout Home Care, a Medicare and private duty agency, which he grew into three operating companies in Dallas and Houston before selling to Humana in 2014 using Stoneridge Partners. After the sale of his own company Joe joined Stoneridge, and for the last ten years has used his industry knowledge to help other owners list their companies and bring them to a successful close. With a proven track record in operations and M&A, Joe brings unmatched experience and

professionalism to every transaction.

For more information, please contact Joe directly at 214-394-0070 or [email protected]. All communications are confidential.