Introduction

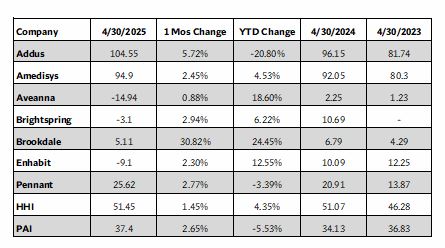

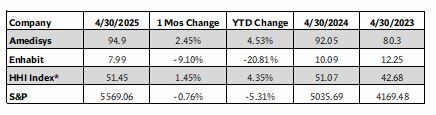

In April 2025, the Home Health Index (HHI) rose 1.45% bringing its total year-to-date (YTD) gain to 4.35%. The Post-Acute Care Index (PAI) gained 2.65% month-over-month (MoM), though it remains down 5.53% YTD. Meanwhile, the S&P 500 fell 0.76% MoM and is down 5.31% YTD.

April 2025 witnessed significant market volatility, primarily due to new U.S. tariffs announced on April 2, leading to a sharp downturn in global markets.

Following April 2, the S&P 500 experienced a historic two-day loss, shedding roughly $6.6 trillion in value. However, markets began to rebound later in the month as positive inflation data emerged and the administration paused certain tariffs, announced a trade deal with Britian, and entered trade talks with China and other trade partners.

Separately, as organizations look to address access to home health services, UnitedHealthcare, effective April 1, 2025, eliminated prior authorization requirements for these services managed by its Home & Community program (formerly naviHealth) across Medicare Advantage and Dual Special Needs Plans in more than 30 states.

The change eliminates preauthorization denials in those instances and will presumably reduce delays in care, cut administrative workload for home health agencies, and improve patient access—particularly for providers serving large MA populations.

“As the stock market finds its footing and we make our way through the 2nd quarter of 2025, we’re continuing to see robust M&A activity at Stoneridge,” said Joe Lynch, Partner and Managing Director. “Buyers continue to demonstrate strong interest in attractive targets, and we’re seeing good creativity when dealing with the more challenging deals.”

Home Health Index (HHI)

Amedisys released its first quarter 2025 financial results announcing a Q1 revenue of $598.8M, which represents a 4.1% year-over-year increase from Q1 2024. Its stock posted a 2.45% gain in April and is up 4.53% YTD.

The company continues to navigate an antitrust lawsuit from the Department of Justice (DOJ) regarding its pending acquisition by UnitedHealth Group (UNH). In order to address the issues raised, Amedisys has been looking for a divestment partner. Following the decision to halt its divestment to VitalCaring roughly four months ago, Amedisys and UnitedHealth struck a new agreement to offload certain home health and hospice care centers to affiliates of BrightSpring and Pennant Group. However, roughly two weeks after the divestment to Pennant and BrightSpring was announced, the DOJ reportedly rejected the antitrust remedy proposal.

Looking forward, the DOJ’s case against UnitedHealth and Amedisys is set to go to mediation before a magistrate judge in August of this year.

In April, Enhabit posted a 9.10% MoM decrease in its stock price but is still up 2.30% for the year. In early May, Barb Jacobsmeyer, president and CEO of Enhabit praised its Q1 performance, stating “Enhabit’s first quarter 2025 results are a product of steadfast execution of our strategies,” noting that “Home health census grew 3.7% sequentially and hospice census grew 12.3% year over year.”

Post-Acute Care Index (PAI)

BrightSpring saw a 3.10% decline in stock price in April but remains up 2.94% YTD. For the first quarter 2025, the company announced a Net Income from Continuing Operations of $9.2 million, compared to a Net Loss from Continuing Operations of $56.0 million in the first quarter of 2024.

According to Jon Rousseau, Chairman, President, and Chief Executive Officer, “BrightSpring’s focus on serving patients with quality and efficient care in home and community settings continues to be foundational to the Company’s growth and financial performance.”

Brookdale was one of the PAI’s top performing companies in April with a 5.11% monthly gain and a strong 30.82% YTD increase in stock price. Brookdale appeared pleased with its Q1 2025 results. Denise Warren, Brookdale’s Interim Chief Executive Officer and Chairman stated, “Our solid first quarter results and annual guidance raise are a testament to the significant momentum underway at Brookdale as we continue to meet the diverse needs of the large aging older adult population.”

The Pennant Group saw a 2.77% MoM stock price increase but is down 3.39% YTD. Continuing to be acquisitive, the company announced in early May that it acquired a Senior Living Community in Arizona, increasing their operations by 128 units.

“This acquisition aligns with our mission to provide life-changing service as we create active, supportive communities where seniors can thrive,” said Brent Guerisoli, Chief Executive Officer of Pennant. “By expanding our services and adding to the strong portfolio of existing properties in Arizona, Pennant is reinforcing its commitment to providing high-quality, compassionate care for our residents.”

Conclusion

As US Trade Policy continues to play out in 2025, companies in the HHI and PAI seem to be focusing on core values, posting positive Q1 results, and remaining acquisitive, all of which lend itself to a continued positive outlook for M&A in the second half of 2025 as well as expanding and improving vital resources for the aging population in the US.

Quote of the Month

“There’s a persistent misconception that older adults aren’t interested in mental healthcare, but the data tells a different story. For many, it’s not a lack of interest, its stigma, affordability, and confusion about how to get started. Integrating mental health support into primary care and normalizing these conversations can help bridge the gap for this generation.” – Doug Newton, M.D., M.P.H, Chief Medical Officer of Rula Health

Read the Full Article Here: Unique Generational Mental Health Needs Highlight Demand For Personalized Care, Survey Finds

Stoneridge In the News:

Key Trends in Behavioral Health M&A Read the Full Article Here – Blog written by Associate Partner Peter Lynch.

Stoneridge Partners, Joe Lynch and Tom Lillis, provided sell-side M&A advisory services to a home health company in Ohio. Read the Full Article Here

See It To Believe It!

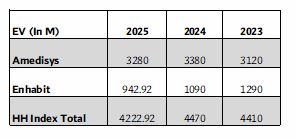

The Stoneridge Partners Home Health Index (HH Index) is updated monthly and measures the performance of these two publicly traded home health companies, all listed on the NASDAQ:

- Amedisys (AMED)

- Enhabit (EHAB)

Here are the results of the stock prices for the past two years:

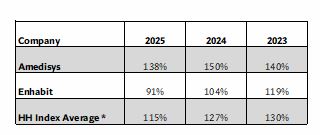

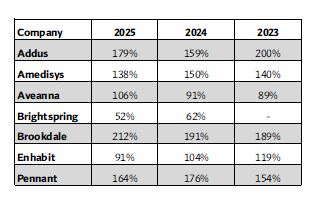

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

The Stoneridge Partners Post-Acute Care Index is updated monthly and measures the performance of these seven publicly traded post-acute care companies, all listed on the NASDAQ:

- Addus (ADUS)

- Amedisys (AMED)

- Aveanna (AVAH)

- Brightspring (BTSG)

- Brookdale Senior Living Inc. (BKD)

- Enhabit (EHAB)

- The Pennant Group, Inc. (PNTG)

Here are the results of the Post-Acute stock prices for the past two years:

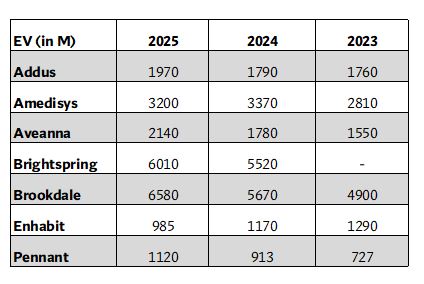

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

The above calculations are based on the selling price being defined as Enterprise Value (EV), with data provided by Yahoo Finance. Enterprise value is defined as market cap plus debt, minority interest, and preferred shares, minus total cash and cash equivalents. EBITDA is calculated using a methodology that may differ from that used by a company for its reporting. (Home Health Index April 2025 | Stoneridge Partners)

Recent Transactions From Around The Country

- The nonprofit Medicare Advantage and health care services organization SCAN Group has fully acquired the myPlace Health

- Help at Home acquires Home Care Now of Central Florida

SOLD by Stoneridge!!!

- Stoneridge Partners is proud to announce the successful sale of an Ohio home health agency.

View Stoneridge closed transactions on our Website.

Exclusively Listed For Sale By Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Mental health counseling & therapy center. $1M in revenue. Long-established practice with excellent reputation.

Home care company. $7M in revenue. 20%+ AEBITDA. 90%+ non-medical. Primarily auto-injury related/long-term clients. Payor sources are mainly auto insurers.

Fully licensed and accredited SUD clinic. $3.5M in annual revenue. Operating continuously for over 40 years. 2 locations with residential and outpatient services.

Home care agency. $16M+ revenue. 100% Medicaid-reimbursed. Approx. 50% skilled/50% non-medical. Medicare-certified.

Home health agency. $3M in revenue. 75% Medicaid, but Medicare Certification as well. Long history of success.

4 adult care homes in Eastern NC. 99 beds licensed under adult care homes. CON status on this license category in NC. Some renovations needed,...

Non-skilled home care agency. $3.7M in revenue. 100% Medicaid. 2 offices in major metro locations.

Medicaid home health provider in major Texas MSA. $1.9M of 2025 annualized revenue. 20-year history in the community. Quality staff in place.

Multi-State Mental Health Services Provider. $2.75M in revenue. Efficient cost structure and consistent earnings. Proven scalable platform.

Fully licensed and accredited behavioral health clinic. Licensed for outpatient substance abuse and mental health therapy. Other license categories are easy to add. Credentialed with...

Medicaid wavier provider. Serving six counties in south central PA for 25+ years. Licensed to provide CHC, Attendant Care ACT 150, and OBRA Waivers. $262k...

Medicare-certified home health agency. $3.2M in LTM revenue. Medicaid programs comprise nearly 65% of the revenue. VA and private insurance. 4 locations serving 21 counties.

Hospice. 160+ ADC and growing. Multiple locations. No CAP issues.

Independent home health provider. $16.8M LTM in revenue with 13.1% EBITDA. Organic growth of 16.7% over the last 3 years. 44% traditional Medicare, 49% Medicare...

Home care agency specializing in Medicaid family-supported services. $10M in revenue/$3M EBITDA. 10-year history. Locally acclaimed.

Medicare-certified home health agency. $15M+ in revenue. All skilled. Experienced leadership team. Accredited.

Home health and home care agency providing care to Medicare, Medicaid LTC Waiver, Pediatric and Advanced Neurological patients. $4.5M in revenue. AEBITDA of over 12%. ...

Hospice and IPU. $5.5M in revenue. Deep community ties in a major MSA. Highly dedicated and trained staff.

Home care company. $6M in revenue. Non-medical. Medicaid. Family Caregivers.

Home Care / Pennsylvania / Popular

Home health & hospice. $10M in revenue. Great referral sources. Well-established. On HCHB.

Home care company. $7M in revenue. Private pay, non-medical. Accredited.

Medicare and Medicaid-certified home health agency. Approx. $400k in revenue. Central Arizona.

Professionally operated home health agency. $1.8M in revenue. 20% EBITDA margins. 20+ years in the Houston market.

Home Health / Texas / Popular

Home care franchise. $1.3M in revenue. 13+ years in business. Large territory with growth potential.

Outpatient behavioral health provider. $4.5M+ in LTM revenue. Year-over-year revenue growth. Growth/expansion opportunities with a new location and new services. Licensed to serve a total...

Behavioral Health / Pennsylvania / Popular

Nurse registry. $7M in revenue. 100% private pay. Primarily non-medical home care. District 9.

Long-established Medicare/Medicaid home health agency with multiple locations. $7.3M in revenue. Good payor mix. On Homecare Homebase.

Home Health / Ohio / Popular

Home health agency in 2 states, one a CON. $3M+ in revenue. Good payor mix. 5-star patient survey rating.

Home Health / Multi-State / Popular

I/DD provider offering SCL & FHP services. $3M in revenue. Recent rate increase. Strong history in their community.

Behavioral health provider. $5.5M+ revenue with solid EBITDA margins. Leading edge service provider and with proprietary state contracts. Unique combination of service options and contracts...

Behavioral Health / Maryland / Popular

Medicaid/Medicare home health & home care company. $2.5M in revenue. Well-established. Stable revenue. Profitable year-over-year.

Home Health / Connecticut / Popular

Designer/Distributor of innovative, therapeutic, health and wellness personal products. $1.5M+ in revenue. Launched in the US and UK, now launching into the EU. Nearly 7,000...

Staffing Agency licensed to provide staffing services in 6 states. $ 2.4M+ in LTM revenue. Significant long-term contracts with providers in the Care-At-Home space, Health...

Other / Massachusetts / Popular

Homecare agency. $6.5M+ in revenue. Located on Long Island. Blend of Private Duty & Medicaid patients.

Maricopa County hospice. 40+ ADC. CHAP accredited. No CAP or regulatory issues.

Growing ABA (Autism) therapy clinic established in 2020. $1.6M in revenue. Market demand heavily outweighs supply in the area for ABA therapy.

Northeast Oklahoma home health company. $1.7M of revenue and profitable. 95% traditional Medicare. Long history in the area.

Home Health / Oklahoma / Popular

Special education and tutorial provider with limited access contracts. $3M in revenue. Strong relationships with county school programs. Long history in the community, close to...

Medicare-certified home health agency. $1.25M in revenue. AHCA accredited. Broward County (Region 10)

Home Health / Florida / Popular

Medicare-certified home health agency. Region 7, including sought-after Orange county (Orlando). Minimal census.

Home Health / Florida / Popular

$5M in revenue. Located in Northern/Richmond VA. Health system-owned Medicare home health. Growing organization.

Home Health / Popular

Hospice. 45+ ADC. Rio Grande Valley. No CAP or regulatory issues.

$40M+ home care agency with 20+% AEBITDA. Primarily private-duty, non-medical (90%). Medicaid waiver programs. 40% family caregivers. Multiple locations.

Home Care / Pennsylvania / Popular

Home Health Index April 2025 | Stoneridge Partners

From Joe Lynch, Publisher of “Home Health Index.” Joe can be reached at [email protected] or (239) 561-0826, and toll-free at 800-218-3944. Previous editions of this monthly newsletter can be searched for at the bottom of the home page of the Home Health Index.

Joe Lynch, Partner and Managing Director at Stoneridge Partners brings over 30 years of healthcare expertise, specializing in mergers and acquisitions, finance, regulatory compliance, and business development. After earning his Business Administration degree from the University of Mississippi, Joe helped expand OrNda Healthcorp’s (now Tenet’s) home health care division.

In 1997, Joe founded Reachout Home Care, a Medicare and private duty agency, which he grew into three operating companies in Dallas and Houston before selling to Humana in 2014 using Stoneridge Partners. After the sale of his own company Joe joined Stoneridge, and for the last ten years has used his industry knowledge to help other owners list their companies and bring them to a successful close. With a proven track record in operations and M&A, Joe brings unmatched experience and

professionalism to every transaction.

For more information, please contact Joe directly at 214-394-0070 or [email protected]. All communications are confidential.