Introduction

May 2025 saw a strong rebound across both the home-based care sector and broader U.S. markets following some volatility in April. The Home Health Index (HHI) rose 1.90% month-over-month (MoM), bringing its total year-to-date (YTD) gain to 6.33%. The Post-Acute Care Index (PAI) surged 7.06% in May, turning positive for the year with a 1.14% YTD increase. Meanwhile, the S&P 500 gained 6.15% MoM and is now up 0.51% YTD.

This rebound comes amid ongoing uncertainty regarding U.S. trade policy, which sparked a historic drop in the S&P 500 following April 2nd, 2025. While May saw solid recovery across U.S. Markets, tariff negotiations are still unfolding, and global markets remain sensitive to further developments.

Separately, UnitedHealth Group’s (NYSE: UNH) stock experienced a significant drop in May, reaching a five-year low. During this period, UnitedHealth announced that its former CEO, Stephen Hemsley, would replace Andrew Witty, who appears to have stepped down from his position. Additionally, the company continues to operate under pressure from the Department of Justice (DOJ) regarding its proposed acquisition of Amedisys.

“As we approach mid-year, M&A in the home-based care space remains active and strong,” said Ben Bogan, Partner and Managing Director at Stoneridge Partners. “Sellers are capitalizing on the current interest from buyers looking to expand their service lines and territories through acquisition.”

Home Health Index (HHI)

In May, Amedisys’ stock posted a month-over-month decrease of 0.57%, bringing its year-to-date gain to 3.93%.

Amedisys continues to navigate its proposed $3.3B acquisition by UnitedHealth, which was initially announced in June 2023. In November of last year, the DOJ filed an antitrust lawsuit to block the merger, adding an additional layer of complexity to the deal. The two companies are scheduled to go to court-directed mediation on August 18th, barring any unexpected resolutions to the lawsuit before that date.

Enhabit’s stock posted a substantial 31.16% gain in May, bringing its YTD gain to 34.19%. In Q1 2025, the company’s hospice segment posted year-over-year gains of 20.5% in Net Service Revenue and an impressive 64.8% in segment Adjusted EBITDA.

Post-Acute Care Index (PAI)

Addus’s stock saw a 6.08% gain in May and is down 11.52% for the year. At the end of Q1 2025, Addus posted year-over-year increases of 20.3% in net service revenues and 25.1% in Adjusted EBITDA. Chairman and CEO Dirk Allison praised the company’s Q1 performance, adding that “These results reflect solid organic growth and include the first full quarter of the personal care operations of Gentiva, which we acquired on December 2, 2024.”

BrightSpring was among the highest-performing companies in the PAI in May, with a solid 36.17% stock gain MoM and 40.16% gain YTD. Additionally, in its Q1 2025 financials release, the company noted a 25.9% increase in Net Revenue and a 28.2% increase in Adjusted EBITDA compared to Q1 2024.

Chairman, President, and CEO Jon Rousseau noted, “We are pleased with our first quarter results across the Pharmacy and Provider service lines, as we reach more patients with high-quality solutions, leverage our scaled platform and processes, and invest in best practices and the future. We remain confident in our team’s ability to bring timely, coordinated, and impactful services and care to the populations we serve, where they are.”

Aveanna has completed its acquisition of Thrive Skilled Pediatric Care, which strengthens its existing footprint and expands its care platform in two new states. According to CEO Jeff Shaner, “The addition of Thrive Skilled Pediatric Care to Aveanna creates a tremendous growth opportunity for the combined company” adding that “Thrive SPC is an exceptional company with a perfect geographical fit for us, and together we share a true commitment to clinical excellence and compassionate care.”

In May 2025, Aveanna’s stock saw a 15.62% gain MoM, bringing its YTD gain to 16.63%.

Conclusion

After a turbulent April, May brought a strong rebound for US markets. As Trade Policy continues to unfold, however, and other world events continue to take shape, it is anticipated that future fluctuations in the market will continue. Despite this anticipated variability in the overall market, home-based care M&A continues a strong march forward as buyers in this space demonstrate continued demand and a seemingly voracious appetite for attractive targets across the US.

Quote of the Month

In acknowledgement of May being Mental Health Awareness month, “Mental health is central to the vitality and resilience of our nation. Achieving ambitious goals, such as ‘Making America Healthy Again’ and reducing chronic disease — depends on prioritizing access to effective mental and behavioral health resources and services people need to achieve optimal health.”

– CEO Alliance for Mental Health

Read the Full Article Here: Letter from the CEO Alliance For Mental Health to Congress

Stoneridge In the News:

Key Trends in Behavioral Health M&A Read the Full Article Here – Blog written by Associate Partner Peter Lynch.

Stoneridge Partners, Joe Lynch and Tom Lillis, provided sell-side M&A advisory services to a home health company in Ohio. Read the Full Article Here

Stoneridge Partners, Jenna Schwartz and Josh Hibbert, provided buy-side M&A advisory services to a home health company in North Carolina. Read the Full Article Here

See It To Believe It!

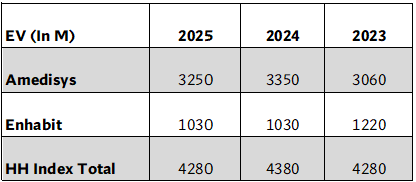

The Stoneridge Partners Home Health Index (HH Index) is updated monthly and measures the performance of these two publicly traded home health companies, all listed on the NASDAQ:

- Amedisys (AMED)

- Enhabit (EHAB)

Here are the results of the stock prices for the past two years:

Enterprise Value (EV)

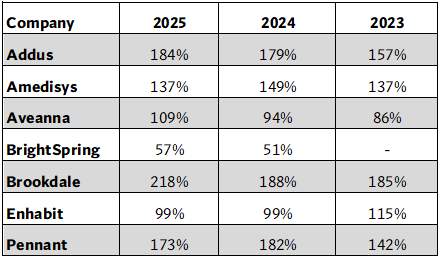

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

The Stoneridge Partners Post-Acute Care Index is updated monthly and measures the performance of these seven publicly traded post-acute care companies, all listed on the NASDAQ:

- Addus (ADUS)

- Amedisys (AMED)

- Aveanna (AVAH)

- BrightSpring (BTSG)

- Brookdale Senior Living Inc. (BKD)

- Enhabit (EHAB)

- The Pennant Group, Inc. (PNTG)

Here are the results of the Post-Acute stock prices for the past two years:

Enterprise Value (EV)

Enterprise Value (EV), aka Selling Price, as Percent of Revenue

The above calculations are based on the selling price being defined as Enterprise Value (EV), with data provided by Yahoo Finance. Enterprise value is defined as market cap plus debt, minority interest, and preferred shares, minus total cash and cash equivalents. EBITDA is calculated using a methodology that may differ from that used by a company for its reporting. (Home Health Index May 2025 | Stoneridge Partners)

Recent Transactions From Around The Country

- HomeCentris Healthcare, LLC Announces the Acquisition of Family First Home Healthcare, LLC

- DispatchHealth and Medically Home Merger Closes, Creating a National Platform for Complex Care at Home

SOLD by Stoneridge!!!

- Stoneridge Partners is proud to announce the successful sale of an Ohio home health agency.

- Stoneridge Partners is proud to announce the successful sale of a North Carolina home care agency.

View Stoneridge closed transactions on our Website.

Exclusively Listed For Sale By Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Do you know of any acquisitions that have taken place? We are interested in your comments. Contact us at Stoneridge Partners.

Mental health counseling & therapy center. $1M in revenue. Long-established practice with excellent reputation.

Home care company. $7M in revenue. 20%+ AEBITDA. 90%+ non-medical. Primarily auto-injury related/long-term clients. Payor sources are mainly auto insurers.

Fully licensed and accredited SUD clinic. $3.5M in annual revenue. Operating continuously for over 40 years. 2 locations with residential and outpatient services.

Home care agency. $16M+ revenue. 100% Medicaid-reimbursed. Approx. 50% skilled/50% non-medical. Medicare-certified.

Home health agency. $3M in revenue. 75% Medicaid, but Medicare Certification as well. Long history of success.

4 adult care homes in Eastern NC. 99 beds licensed under adult care homes. CON status on this license category in NC. Some renovations needed,...

Non-skilled home care agency. $3.7M in revenue. 100% Medicaid. 2 offices in major metro locations.

Medicaid home health provider in major Texas MSA. $1.9M of 2025 annualized revenue. 20-year history in the community. Quality staff in place.

Multi-State Mental Health Services Provider. $2.75M in revenue. Efficient cost structure and consistent earnings. Proven scalable platform.

Fully licensed and accredited behavioral health clinic. Licensed for outpatient substance abuse and mental health therapy. Other license categories are easy to add. Credentialed with...

Medicaid wavier provider. Serving six counties in south central PA for 25+ years. Licensed to provide CHC, Attendant Care ACT 150, and OBRA Waivers. $262k...

Medicare-certified home health agency. $3.2M in LTM revenue. Medicaid programs comprise nearly 65% of the revenue. VA and private insurance. 4 locations serving 21 counties.

Hospice. 160+ ADC and growing. Multiple locations. No CAP issues.

Independent home health provider. $16.8M LTM in revenue with 13.1% EBITDA. Organic growth of 16.7% over the last 3 years. 44% traditional Medicare, 49% Medicare...

Home care agency specializing in Medicaid family-supported services. $10M in revenue/$3M EBITDA. 10-year history. Locally acclaimed.

Medicare-certified home health agency. $15M+ in revenue. All skilled. Experienced leadership team. Accredited.

Home health and home care agency providing care to Medicare, Medicaid LTC Waiver, Pediatric and Advanced Neurological patients. $4.5M in revenue. AEBITDA of over 12%. ...

Hospice and IPU. $5.5M in revenue. Deep community ties in a major MSA. Highly dedicated and trained staff.

Home care company. $6M in revenue. Non-medical. Medicaid. Family Caregivers.

Home Care / Pennsylvania / Popular

Home health & hospice. $10M in revenue. Great referral sources. Well-established. On HCHB.

Home care company. $7M in revenue. Private pay, non-medical. Accredited.

Medicare and Medicaid-certified home health agency. Approx. $400k in revenue. Central Arizona.

Professionally operated home health agency. $1.8M in revenue. 20% EBITDA margins. 20+ years in the Houston market.

Home Health / Texas / Popular

Home care franchise. $1.3M in revenue. 13+ years in business. Large territory with growth potential.

Outpatient behavioral health provider. $4.5M+ in LTM revenue. Year-over-year revenue growth. Growth/expansion opportunities with a new location and new services. Licensed to serve a total...

Behavioral Health / Pennsylvania / Popular

Nurse registry. $7M in revenue. 100% private pay. Primarily non-medical home care. District 9.

Long-established Medicare/Medicaid home health agency with multiple locations. $7.3M in revenue. Good payor mix. On Homecare Homebase.

Home Health / Ohio / Popular

Home health agency in 2 states, one a CON. $3M+ in revenue. Good payor mix. 5-star patient survey rating.

Home Health / Multi-State / Popular

I/DD provider offering SCL & FHP services. $3M in revenue. Recent rate increase. Strong history in their community.

Behavioral health provider. $5.5M+ revenue with solid EBITDA margins. Leading edge service provider and with proprietary state contracts. Unique combination of service options and contracts...

Behavioral Health / Maryland / Popular

Medicaid/Medicare home health & home care company. $2.5M in revenue. Well-established. Stable revenue. Profitable year-over-year.

Home Health / Connecticut / Popular

Designer/Distributor of innovative, therapeutic, health and wellness personal products. $1.5M+ in revenue. Launched in the US and UK, now launching into the EU. Nearly 7,000...

Staffing Agency licensed to provide staffing services in 6 states. $ 2.4M+ in LTM revenue. Significant long-term contracts with providers in the Care-At-Home space, Health...

Other / Massachusetts / Popular

Homecare agency. $6.5M+ in revenue. Located on Long Island. Blend of Private Duty & Medicaid patients.

Maricopa County hospice. 40+ ADC. CHAP accredited. No CAP or regulatory issues.

Growing ABA (Autism) therapy clinic established in 2020. $1.6M in revenue. Market demand heavily outweighs supply in the area for ABA therapy.

Northeast Oklahoma home health company. $1.7M of revenue and profitable. 95% traditional Medicare. Long history in the area.

Home Health / Oklahoma / Popular

Special education and tutorial provider with limited access contracts. $3M in revenue. Strong relationships with county school programs. Long history in the community, close to...

Medicare-certified home health agency. $1.25M in revenue. AHCA accredited. Broward County (Region 10)

Home Health / Florida / Popular

Medicare-certified home health agency. Region 7, including sought-after Orange county (Orlando). Minimal census.

Home Health / Florida / Popular

$5M in revenue. Located in Northern/Richmond VA. Health system-owned Medicare home health. Growing organization.

Home Health / Popular

Hospice. 45+ ADC. Rio Grande Valley. No CAP or regulatory issues.

$40M+ home care agency with 20+% AEBITDA. Primarily private-duty, non-medical (90%). Medicaid waiver programs. 40% family caregivers. Multiple locations.

Home Care / Pennsylvania / Popular

Home Health Index May 2025 | Stoneridge Partners

From Ben Bogan, Publisher of “Home Health Index.” Ben can be reached at [email protected] or (239) 561-0826, and toll-free at 800-218-3944. Previous editions of this monthly newsletter can be searched for at the bottom of the home page of the Home Health Index.

Ben Bogan, J.D., Partner and Managing Director at Stoneridge Partners, has been a leading figure in healthcare M&A since 2014, specializing in home health, home care, and hospice transactions. With over 70 successful closed deals, Ben’s experience and expertise have set him apart as a skilled and invaluable intermediary in the industry.

With a law degree from Albany Law School, a BSBA in Economics from the University of Florida, and his background as a former Assistant District Attorney and Assistant District Counsel for the U.S. Army Corps of Engineers, Ben combines his legal background and M&A expertise to deliver exceptional results in every transaction. Available to his clients 24/7, Ben builds strong relationships with his clients and has garnered rave reviews.

For more information, please contact Ben directly at 520-991-4653 or [email protected]. All communications are confidential.